|

Reliability of Short Sale Letters?

By Lisa A. Tyler

National Escrow Administrator

Side deals are becoming increasingly problematic with some short sale lenders. A number of junior lienholders have made "side deals" with other participants in the transaction, such as the buyer and real estate agents, for amounts to be paid outside of escrow in addition to the maximum in the senior lien holder's short pay letter. When those parties fail to pay additional sums to the junior lienholder, they are sometimes refusing our payoff funds and threatening foreclosure. In most cases, we have already insured free and clear marketable title to the new owner, and sometimes a first lien position, to their purchase money lender.

In those States that have specific payoff statutes the settlement agent can rely on the amounts provided in the payoff letter – typically up to thirty days. The Company has used those statutes against the payoff lender as our first course of legal defense when the lender demands more funds post-closing than called for in their original short sale approval letter. Defending the Company becomes harder in states where no such statutes are available to back up our case. Read the article entitled "Side Deals" to become aware of the issues and some possible resolutions.

The second story recounts how, often, common names are easily stolen. Desperate individuals out there are posing as sellers and absconding with profits. In the article "Imposter!" read how one man got away with identity theft.

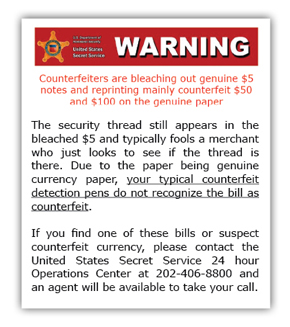

Our last story, "Counterfeit Cash" is about counterfeiters bleaching out $5 bills and making them into $100 bills. Not that we take cash very often but, from time-to-time, offices have made the business decision to accept cash at the closing. When cash is accepted, the cash should be inspected – preferably held under the Fraud Fighter black light – to ensure it is not counterfeit or bleached and the denomination changed.

Fraud Insights can be used as a creative marketing tool and a conversation starter! Two ideas that have been implemented to communicate the stories in Fraud Insights:

- Create an e-mail distribution list for your customers and share the newsletter by forwarding the electronic version to your customers each and every month.

- Attach your business cards to the hard copy version and hand deliver it to your customers on a monthly basis. It will give you something new to talk about when you see them!

|

|

|

|

|

Fraud Insights Quiz

We're taking our Quiz Section on line! The quiz section of Fraud Insights tests your retention of the information learned in this and previous editions. Remember, all previous editions of Fraud Insights can be accessed at the Company's intranet under Internal Publications.

FNF associates can participate in this month's quiz by typing the link below into their Web browser: http://fraudquiz.fnf.com. Answers will be published in the October issue of Fraud Insights.

All quiz entries will be entered to win a Starbucks gift card.

Below are the associates who submitted the correct answers first in their respective time zone for the August Fraud Insights Quiz and as a result received a $10 Starbucks giftcard.

- Amy White, Claims Counsel

Fidelity National Title Group

Jacksonville, FL

- Salih Hadzic, Underwriting Department

Fidelity National Insurance Company

Jacksonville, FL

- Carol Maier, Legal Assistant

Fidelity National Title Group

Jacksonville, FL

- Valerie Russell, Post Closing Specialist

Fidelity National Title Group

Richmond, VA

- Cecilia Lawrence, Escrow Assistant

Chicago Title Insurance Company

Houston, TX

- Allison Riddle, Human Resources

Fidelity National Title Group

Grand Rapids, MI

- Susan Rausch, Examiner

Chicago Titile Company

Sycamore, IL

- Chris Ziegler, Title Examiner

Fidelity National Title Group

Tempe, AZ

- Amy Nomura, Locator

Property Insight

Chatsworth, CA

- Diane Asposto, Escrow Officer

Chicago Title Company

Irvine, CA

|

|

Side Deals

Loan investors such as Fannie Mae and Freddie Mac have guidelines that must be followed by loan servicers when negotiating a short sale letter. Those guidelines often dictate the maximum allowable payment to any junior lienholders. The investor's guidelines take into account that, without a short sale agreement, the junior lienholder would receive nothing. If the first lienholder elected to foreclose rather than enter into a short sale agreement, the second lienholder would receive nothing. Therefore, the first lienholder, in some cases, limits payments to the second lienholder to no more than $1,000 or sometimes $3,000. As a result, second lienholders are trying to force more money out of the transaction by making side deals.

In this down market, we have seen a number of second lienholders trying to "skirt" the maximum amount allowed by the first lienholder by making side deals with the buyer and real estate agents in the transaction. At first, the second lienholders were blatantly including amounts in the footer section of their payoff letter to be Paid Outside Closing (POC) by the buyer or real estate agents. When our settlement agents began refusing to close with the POC condition in the letter the lender's moved on to other tactics.

In one recent transaction, the short pay letter from the first lienholder, Countrywide Home Loans, dictated no more than $5,000 to be paid to the second lienholder, CitiMortgage. We received a short pay letter from CitiMortgage reflecting the same $5,000 amount. We closed the transaction and ten (10) days later the escrow officer received an e-mail from a loss mitigator employed by CitiMortgage stating the $5,000 wire was being returned and that the lender would be pursuing foreclosure.

The escrow officer panicked since she had closed the file 10 days prior insuring free and clear marketable title to a new owner and a first lien position to a new purchase money lender. She responded to the loss mitigator asking why the funds were being returned. His response was that the buyer and the short sale negotiator had a "side deal" with CitiMortgage to send a wire transfer for an additional $9,141.10 on the date of closing. The buyer faxed an instruction to his bank to send the wire on the date of closing as proof of his concurrence with the "side deal." On the date of closing, however, the buyer rescinded his wire and the funds were never transmitted.

As a result, CitiMortgage notified the escrow officer they were rescinding their short pay letter to Fidelity National Title and initiating foreclosure. The escrow officer notified the seller and the real estate agents. She then turned her file over to FNF's National Escrow Administration.

The escrow administrators sent an immediate response to CitiMortgage quoting the payoff statutes for the State of California – where the property was located and the closing occurred. Here is an excerpt from that response:

| |

To clarify our position, enclosed is a copy of California Civil code Section 2943 which requires that all payoff demands covering California loans must be for a period of not less than 30 days and can be relied upon for such a period of time by the settlement agent. Any changes during that time to the demand figures must be verified by the lender in writing to the holder of the demand statement within 24 hours of any verbal notification of said change. Should written notice not be given, the settlement agent may rely upon the payoff demand on its face and proceed with the reasonable expectation of receiving a reconveyance of the deed of trust security said loan. Any deficit due to a change in the figure shall be construed to become an unsecured loan on behalf of the lender.

|

The response letter informed the lender we would not accept a return of our wired funds and that if the lien wasn't released within the statutory period, the Company would file a release of obligation, releasing the lien.

Luckily for us, it turned out the loss mitigator was dumb enough to document the entire side deal in e-mails to the escrow administrator. In response to our letter she forwarded the chain of events to the Fraud Investigative Unit at CitiMortgage. After reviewing the chain of e-mails, the Chief Fraud Investigator confirmed the $5,000 would be accepted in exchange for a full lien release and any foreclosure actions would cease immediately.

Moral of the Story

First and foremost, if the parties make you aware of a side agreement, do not proceed to close. Make the first lienholder aware of any side deals and only close when you have conveyed the facts and received the first lienholder's authorization to close.

Secondly, if the lienholder refuses to release their lien post-closing, get the seller involved immediately. In other situations like the one in the above article we have opted to get the consumer involved by having them call the lending institution and inform them of their intent to notify the OCC and other federal regulators of their deceptive practices. Often times, the lender will listen to a consumer over the settlement agent and will reverse their decision to refuse payment. Also, some states require the lender to release their lien within 30 days or suffer penalties to the consumer for non-timely release of their lien.

Should you have a scenario arise like this one, please do not hesitate to contact your national escrow administration team for assistance and guidance. They can be reached 24/7 by e-mail at settlement@fnf.com and by telephone at 949.622.4425.

|

|

Imposter!

A seller with a very common name uses a stolen identification to sell property and abscond with the property owner's proceeds.

The year 2009 has definitely sparked some interesting stories. In three different issues we have published stories illustrating the desperate attempts buyers have made to purchase properties by counterfeit means. The January issue included an example of a Bonded Promissory Note and the story of the all cash buyer. In the August issue we shared the story of the buyer who kept bringing in fake checks for his earnest money and closing costs. You might remember the made up checks even had the same check number. Lastly, this issue provides you with another use for the Fraud Fighter machines which included tips and tricks on how you can detect fake or washed currency.

An all cash transaction was opened selling a piece of vacant land with a quick closing date. The seller came into our office to sign his closing documents. He was a Doctor from a neighboring state. He explained to his escrow officer he needed some cash quick which was the reason he was letting the property go for such a low sales price. The escrow officer reviewed his identification which included placing it under the UV light in her Fraud Fighter machine. The hidden image appeared just as described in her ID checking guide. Everything seemed to check out and the escrow officer closed and disbursed her file.

A few months later, a claim was filed by an attorney representing the true property owner. The attorney stated the person who represented himself as the seller was an imposter. How could this have happened? The escrow officer herself identified the seller. Turns out the seller had a very common last name, Lee. The individual who represented himself as the seller used a valid, but stolen driver's license. The license was for someone with exactly the same name as the true property owner and the physical description was also very similar.

Hindsight is always 20/20. Knowing what she knows now – surely the escrow officer would have scrutinized the identification even closer comparing the picture and signature, as well as the physical description, but was there something more she could have done? Tech Memo 45-2005 entitled Opening Letter for Fraud Alert was issued to assist in catching this type of fraud before it is too late. In a nut shell, it states when a transaction is opened a letter should be sent to the seller or borrower at the same mailing address for the tax bill if different than the address provided at the opening of escrow. A sample letter is provided in the tech memo.

Moral of the Story

There is no guarantee we can catch all forgeries. This particular gentleman was very brazen. He came into our office, met face-to-face with the escrow officer and even had a believable story. Regardless, do not lose sight of the Company's policies and procedures. They are usually the result of a claim or situation just like this one.

|

|

Counterfeit Cash

As a company we rarely accept cash into our files, but we are seeing an increase in this practice – especially in small dollar amounts. We are also participating in auctions wherein potential buyers might bring cash to the auction which we must accept to keep the business. So with this increasingly common practice, we all need to be more aware of new tricks fraudsters at large are attempting to perpetrate.

The nation has seen this increase occurring not just in small cash amounts, but has also witnessed a strong increase in the amount of cashier's checks and traveler's checks as well. Here is a look at a new scheme the U.S. Department of Homeland Security has put out as a warning:

Counterfeit $100 bills have been circulating now at a higher rate across the country. U.S Secret Service Resident Agent in Charge of the Office in Albuquerque, Richard Ferretti, said "it is apparent the suspects are bleaching off the picture and the number "5" on each $5 bill and replacing them with the number 100 and the $100 bill's picture." If you are just using a marking pen to check the bills you will be losing money. The suspects are using a real $5 bill and changing it into a $100. So the marking pen shows it is good because it is a good bill, but of course, it is not a $100, it is a $5 bill.

How to tell a counterfeit $100 bill

- The only difference you can see quickly is that the ink smears off. The ink is smearing off because the suspects are using a desktop publishing printer with the inexpensive toner, rather than the ink from the Intaglio printing process the bills undergo at federal printing plants.

- Color-shifting ink (ink which appears to change color when the bill is tilted) was added to $100 bills in 1996, $5 and lower bills do not yet have this feature.

- The fibers (embedded) in the paper are different between the $5 and the $100. If you hold up the $5 bill to an ultraviolet light, the fibers are blue. If you hold up the $100 bill to the ultraviolet light, the fibers are pink or red.

The Secret Service believes every company that handles cash should invest in a portable ultraviolet light for their employees. The Secret Service also has noted the most common counterfeited bill is the $20. Below are some pictures of what you would be able to see when looking at a counterfeit bill under a UV light.

Remember! Accepting cash may require the filing of IRS form 8300. For a detailed explanation of the reporting requirements view our Web-based training module on Cash Reporting or refer to Tech Memo 34E. If the local policy is to not accept cash for any transaction, then continue to adhere to that policy.

|

|