|

Let the Rebound Begin in 2010!

By Lisa A. Tyler

National Escrow Administrator

As we prepare for the predicted economic rebound this year, it is important to realize real estate fraud affects our industry in both good times and bad. Read this month's edition to find out about new types of fraud and what you can do to deter fraud in your own transactions.

Did you know under the Truth in Lending Act if a borrower is not provided with the proper "Notice of Right to Cancel" in a residential refinance transaction then his/her three day rescission period extends to three years? Because of this, borrowers are using this type of regulatory relief to get out of legitimate debt. Read "Cancel Your Mortgage! Discover the Power of TILA!" to find out what you can do to protect the Company from future claims regarding the borrower's three day right to cancel a refinance transaction.

Read "First-Time Homebuyer's Credit Scam" to find out how one married couple attempted to use multiple last names to receive an $8,000 refund from the IRS. More importantly, find out what Mona Rodriguez, an escrow officer from Fidelity's Fresno, Calif. office did to stop it.

When a property owner dies without a probate or will it is difficult to determine who are the remaining heirs to the estate. Read "No Probate, No Will = No Closing" to find out why it is better to refer this type of transaction to our competitors.

Incredible Escrow Training!

It's the National Escrow Administration Team to the rescue!

Whether it is figuring out the new HUD form, a question about a transaction or deterring fraud – we can help! Our 2010 escrow training events are under way, arming you with knowledge and powerful tools so you can be a Superhero in the industry! Be sure to register for an event in your area through the Company's Intranet at home.fnf.com.

If you have a heroic story to share, please submit the details to settlement@fnf.com. If your story is selected for a future edition of Fraud Insights the hero in the story will receive a $1,000 reward from the Company as well as a letter of recognition.

|

|

|

|

|

Cancel Your Mortgage!

Discover the Power of TILA!

Borrowers who have fallen on hard times and let their mortgage payments lapse are relying on regulatory relief to help them stay in their homes. Law firms across the nation are advertising to homeowners through the Internet, billboards, radio and late-night television commercials urging them to contact these firms to cancel their mortgages, using a breach of the Truth in Lending Act (TILA) as the basis for cancellation.

The various law firms' advertisements state the firms have solutions for keeping the homeowners in their homes at no additional cost to them. Some firms blatantly advertise to cancel the homeowners' mortgages altogether! Here are some examples of the ads:

| |

"Regardless of your credit....regardless of your situation....you can cancel your mortgage debt using T.I.L.A."

"The bank will want to settle with you because they know that every mortgage contract they make is loaded with T.I.L.A. Violations worth about $50,000 in fines!"

"You can even collect these fines and discharge the mortgage and the bank is happy to do it!"

"Cancel your mortgage…and keep your home!!"

|

Once a homeowner answers the ad, the law firm employee asks the homeowner if he/she still owns the home and if the homeowner refinanced the property anytime during the past three years. If the homeowner answers affirmatively, the firm instructs the homeowner to bring a copy of the refinance closing papers to the law firm's office. The attorneys and paralegals then comb through the paperwork to look for violations of TILA. Specifically, they are looking to see if the homeowner received two copies of the "Three Day Notice of Right to Cancel" for each borrower and to see if the third business day is disclosed on the Notice. Under TILA, if those conditions are not met, the borrower has three years in which to rescind the transaction.

If the attorney finds less than two copies for each borrower or incomplete notices in the loan package, the attorney writes an accusatory letter to the lender quoting the Act and declaring the homeowner's right to cancel the mortgage.

The letter usually reads something like this…

"To this date, lender has never provided borrowers with true, complete, accurate or timely documents as required. Only after such provision has been done can the three day right to cancel period begin. If the required full disclosures have not been provided then the period in which to cancel is extended for up to three years or until lender moves to foreclose. The records thus far evidence that borrowers have requested to cancel within the stipulated three year time period, while still waiting to receive all TILA disclosures as required by federal law, the same of which have never been received."

The borrower signs the letter and sends it to the mortgage company, who then forwards the document to the settlement agent who accepted responsibility for delivery of the notice at the time the loan documents were received."

The settlement agent's role is to oversee the signing and delivery of the notices pursuant to the lender's written instructions. The lender relies on the settlement agent to have a clear understanding of the disclosure requirements and how the right of rescission works. Failure to provide the proper disclosures and follow the rescission requirements could provide a borrower with the ability to claim his/her loan is invalid. If the lender suffers a loss due to the borrower's claim and they think the loss was the responsibility of the settlement agent, pursuant to their instructions, the settlement agent might have to share in any losses.

The three day right of rescission clock does not start ticking until after all three factors have taken place; that is, until the signing is completely finished. The three day rescission period runs when the last of three triggering events occurs. The three events are:

- consummation of the signing;

- delivery by the lender of the notice to the borrower of the right to rescind; and

- delivery by the lender to the borrower of the "material disclosures."

Material disclosures are the various disclosures the lender must give the borrower such as the Truth in Lending statement.

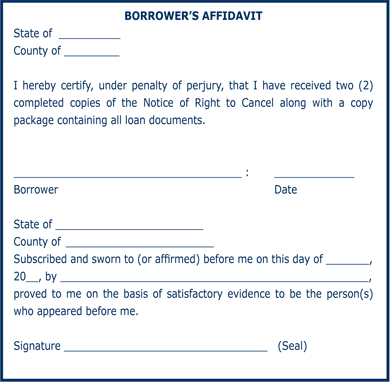

In order to protect the Company from future claims, settlement agents are directed to use the "Borrower's Affidavit" to obtain the borrower's sworn statement that they received the two completed copies of their notice of right to cancel at the signing ceremony. The Company can then use their sworn testimony as our first line of legal defense in future claims.

Needless to say our offices all over the nation are receiving attorneys' letters. If they come to us directly from the attorney, we file the letter and wait to see if we are contacted by our insured, the lender. If the lender contacts the branch, they should be directed to put their potential claim in writing and send it to the claims office as indicated on their final policy of title insurance.

|

|

First-Time Homebuyer's Credit Scam

The Mexican custom of using the paternal grandmother's maiden name is used in the United States to circumvent the First-Time Homebuyer's Credit laws.

In Mexico the father's surname does not suffice on legal documents, men must include their mother's maiden name. The reason is simple and practical: There are so many Hispanics with the same surnames that they need to include their mother's maiden name to legally separate their identities.

A few months ago Mona Rodriguez from Fidelity's Fresno, Calif. operation closed a short sale transaction for Antonio Sandoval Abrica. Mr. Abrica owned the property as his sole and separate property. He sold the property for $90,000 to an investor. There was approximately $206,500 owed to the current lien holder, but they agreed to a short pay amount of $84,000.

The investor returned a month later and opened a new transaction with Mona for the sale of the same property. The buyer in the new transaction was Maria Aguilar Sandoval, a married woman, as her sole and separate property. She was purchasing the property for $115,000 with a 100% seller carry-back financing. The note was for 30 years, but the investor told Mona that Maria would refinance in a few years and pay him in full. Maria was paying all closing costs, including title and escrow fees.

The seller wanted to close by month's end so Maria could claim a First-Time Homebuyer's Credit and receive $8,000 from the IRS.

Mona set an appointment to review the escrow documents with the buyer and notarize her husband's signature on the inter-spousal deed, conveying his interest back to his spouse. Mona was told the husband's name was Antonio Sandoval. When the gentleman arrived Mona asked for his identification, which read "Antonio Sandoval Abrica." Mona asked if he went by any other name, he said no just "Sandoval."

She thought he looked familiar and excused herself from the signing room to do a search on the name "Abrica" in her escrow system. Suddenly she remembered! Mr. Sandoval was really Mr. Abrica, the previous owner of the subject property. Mona felt too uncomfortable to continue with the transaction and halted the document signing appointment. Later, she resigned as escrow holder. She knew several parties to the first and second transactions would be harmed AND the former lien holder could possibly re-attach their lien. If the lien holder re-attached their lien it could cause a title claim.

Who is harmed in this type of transaction?

- The short pay lender who took a shortage of more than $122,500 on their payoff.

- The U.S. taxpayers who would have paid $8,000 to someone who was not qualified to receive the First-Time Homebuyer's Credit.

- The future refinance lender who should know Maria and her husband defaulted on a previous loan that caused a short sale of the property.

What is the definition of a first-time home buyer?

The law defines "first-time home buyer" as a buyer who has not owned a principal residence in the last three years. For married couples, the law tests the homeownership history of both the homeowner and the spouse. For example, if you have not owned a home in the past three years, but your spouse has owned a principal residence, neither you nor your spouse qualifies for the first-time home buyer tax credit! The Sandovals and the investor were attempting to circumvent this law through the use of the paternal grandmother's maiden name.

It probably would have been easier to close, but Mona rightfully resigned. She went one step further to protect the Company by asking the title officer to post the parties' names and property address to the plant records to prevent a sister company from opening the same transaction. For her recognition of a bad deal and for her courage in resigning as escrow holder, the Company rewarded her $1,000 along with a letter of recognition.

|

|

No Probate, No Will = No Closing

One escrow officer refused to close the sale of a mobile home with no land, where the owner was deceased and the heir could not produce a last will and testament – even at the pleading request of a good client. The deal ended up transferring to a competitor – thank goodness!

Lexi Howard, a certified senior escrow officer from Chicago Title's Oxnard, Calif. operation received a request to handle an $80,000 mobile home sale from a real estate broker with whom her office had enjoyed a good, longtime relationship. The transaction had a laundry list of issues: Paid off loans with no documentation, deceased seller with no documentation, lots of repairs, just to name a few. Lexi was told the deal had been around for a long time and needed to close right away or the buyers would walk away from the transaction.

The seller indicated the property had belonged to his now deceased mother and there had been no probate. He assured Lexi he was the only heir to her estate. She requested, as is customary in this type of mobile home transaction, a copy of the will and a copy of the death certificate. She received only the death certificate. After multiple e-mail communications between the seller and his real estate broker repeatedly asking for the copy of the will, Lexi was informed, in mixed communications, there was no will and there was a will but it was lost and couldn't be located. Lexi informed the seller and the broker that without the will, she would not close the transaction because we would not have a basis for accepting the seller's claim as the lawful representative and only heir.

The real estate broker begged to close the deal – begged Lexi, the title rep, the title manager and the county manager. He was certain there was nothing funny on behalf of his client, only a paperwork problem. Lexi told him that, as much as she would love to help, this was a transaction she could not close for him. She mentioned she would cooperate with his choice of a replacement escrow company and with proper instructions from the principals, transfer her work-to-date to another company. He suggested Stewart Title Company, the appropriate instructions from the principals were received and the transaction was subsequently closed by Stewart Title.

Imagine Lexi's sense of vindication when she received the e-mail below. She called the attorney who initiated this e-mail which implies there are other heirs to the un-probated estate. Lexi let the attorney know we had declined to handle the transaction because of the seller's unwillingness to provide the requested documentation establishing his authority to sell the property.

"We are assisting our clients in trying to find out the selling price of a mobile home in the Susana Woods Prestige Mobile Estates at 6480 Katherine Road, Sp. #45, Simi Valley, CA 93063 (parcel #9050140280). We were told by the Housing and Community Development office that the 1976 model mobile home was owned by Betty J. Heckendorn (our client's mother) and Jay Paul Telenda (Betty Heckendorn's grandson) as tenants in common. The detail number of the property is AAR4205. Betty passed away in 2007 and Mr. Telenda sold the mobile home to Shane and Erin Martin on June 25, 2009. The Housing and Community Development office told us that there was no right of survivorship. We have checked with Ventura County probate and a probate was not opened for Betty Heckendorn."

"We would like to know the selling price of the mobile home in the sale to the Martins and how Jay Paul Telenda was able to sell the mobile home to the Martins without a probate of his grandmother's estate. If a title search needs to be done, please advise what your charges would be."

Law offices of Martin Bischoff, et al.

For recognizing the danger in closing the sale of a deceased person's property without a will, probate or proper evidence of no other heirs and for refusing to close even for a good client, Lexi has been rewarded $1,000 and a letter of recognition on behalf of the Company.

Moral of the Story

From the tone of the attorney's e-mail it appears the son who sold the property did not split the proceeds of the sale with at least one other heir to the estate. Had Lexi elected to close the transaction, the Company would be included in any litigation by the harmed heir. The cost of legal defense for the Company would far exceed the $702 it would have earned in revenue had we closed the transaction.

|

|