|

Are We On Candid Camera?

By Lisa A. Tyler

National Escrow Administrator

Imagine receiving a real estate transaction so bizarre you start to think you're being filmed for some crazy, new reality television show. That's the thought Steve Shrope, a title agent from Southern Utah Title, had when one of his offices received a recent sale transaction. The contract called for a $10,000 deposit, but the buyer deposited a check for $106,000, then demanded the difference of $96,000 be wired back to his account in China. That's when Steve asked "Are we on Candid Camera?" Be sure to read his story in this month's edition of Fraud Insights.

Remember! Title agents are eligible to receive rewards for detecting fraud, forgery and other crimes in their transactions.

Those in the real estate industry know better than anyone that we fight for every deal. In the story entitled "E-mail Scams!," one of our title officers saved his customer from going too far in a deal where millions of dollars supposedly were going to be wired "any day" from Africa. In this month's edition, we share with you how a mortgage broker spent weeks putting together a deal that never came to fruition by negotiating with e-mail scammers from Africa.

|

|

|

|

|

Are We On Candid Camera?

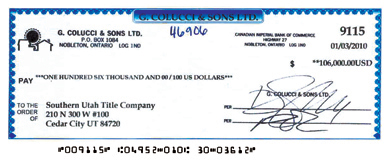

On March 1, 2010, an escrow officer in the Cedar City, Utah branch of Southern Utah Title Company opened a short sale transaction with a sales price of $748,000. The escrow officer was immediately put on guard since the sales price was high for that area and the home had been listed for over a year and a half at a lower price.

The listing agent opened a new transaction with Southern Utah Title and told the escrow officer the sellers were skeptical of the buyer. They wanted to make sure the title company received the earnest money deposit. The buyer's address was in Canada and his name was Ming Xing. The buyer informed escrow he was having his stock broker, Peter Smith, sell off some of his portfolio. Once the check was liquidated, Smith was instructed to send it directly to escrow. Shortly thereafter, Smith called Southern Utah Title to inform them the check was on its way.

The check arrived as promised. Unfortunately, it was drawn on a Canadian bank, so the escrow officer immediately gave the check to the manager, Steve Shrope. Having read the December 2009 edition of Fraud Insights, which provided warnings against accepting foreign checks, Steve decided it was time to review the file thoroughly. Recognizing two heads are better than one, he contacted R. Buck Cowdin, manager of branch operations for Southern Utah Title. They both felt very uneasy about the transaction and decided to contact the buyer.

|

Steve Shrope, Manager

Southern Utah Title |

They informed the buyer it can take weeks – if not months – for foreign checks to clear and they would not be in a position to proceed with the transaction until the check was unconditionally collected at their bank. Steve and Buck further explained to Xing they would be returning his check to him so he could wire the funds instead. Xing stated he was on a business trip in Asia and unable to wire his funds. Xing also stated he had no problem waiting for the check to clear. Xing added he would gladly wire the balance of the closing funds and he would find another title company to close the deal for him if Southern Utah Title could not accommodate him by depositing his check.

Upon further review of the check, Steve noticed that everything was printed by a color dot-matrix printer; the company logo and signatures were also printed on the blank stock paper. The date on the check was also two months prior to the signing of the contract, which was likely entered by someone not familiar with how dates are abbreviated in the U.S. Finally, and perhaps most notably, the contract only called for $10,000 in earnest money yet the check was for $106,000.

The note included on the check stub said:

Detach the above check before deposit and notify the person(s) below:

cc: Mr. Ming Xing Purchase

cc: Mr. Peter Smith-1-205-258-1906

E-mail address: petersmith@financier.com

Steve did not rely on the contact information on the check and instead found the bank's contact information on the Internet. Going one step further, Steve contacted Canadian Imperial Bank of Commerce to verify the issuance of the check. Canadian Imperial Bank of Commerce asked Steve to fax a copy of the check to them.

They confirmed the check was fraudulent.

Right then the plot really thickened. The buyer sent over instructions to wire the additional $96,000 to China for payment of furniture being shipped to the home he was purchasing. Again, the buyer threatened to move the deal to another title company when Southern Utah Title refused to wire the funds. "This is when we thought we were on Candid Camera," said Steve.

Steve did a reverse look-up on the broker's (Peter Smith) phone number only to find it was an Alabama cell phone – not New York as he had been told. Steve notified the real estate agents involved that Southern Utah Title would be resigning from the transaction. No one has heard from the buyer or the stock broker since, and the escrow officer still has the original check. It must not have been as valuable as it appeared! Since they resigned from the transaction, Steve and Buck have learned U.S. Customs and Border Protection seized another check through the mail made out to the buyer's real estate agent.

Buck contacted the National Escrow Administration offices of Fidelity National Financial to share his story. Buck said: "I have asked my Manager of one of the branches in my District to relay our story for your Fraud Insights…hope it helps someone else. It is because of our training, underwriter memos and prior Fraud Insights issues that all these red flags appeared."

For Steve's efforts in detecting the counterfeit check and for sharing the details of his transaction, he has been rewarded $1,000 and a letter of recognition on behalf of the Company.

The December 2009 edition of Fraud Insights contained a story about an operation in Colorado that had received a counterfeit check from a Canadian Bank for a closing in the amount of $725,000. The check was remitted on behalf of Qui Zilei.

Since that time, National Escrow Administration has received reports of the same type of scam in California, New Mexico, Nevada, Oklahoma, Texas and Utah. The names and modus operandi seem to be very similar in every instance. In some cases, the e-mail addresses of the brokers remitting the checks were the same. Here are the specifics:

- In New Mexico, Paul Jackson sent us a check on behalf of Liu Xainghong. On the check stub was this note:

ATTENTION:

Enclosed Draft/Check is been sent to you from our office on behalf of Liu Xainghong advice to send e-mail to paujackson@lnetcentral.com immediately after depositing the check at the bank to notify our verification department. Failure to notify us via e-mail will render this instrument Void in English Language. We prefer communication via e-mail-notification and acknowledgements of the payment received.*

- In California, Green Sound sent this instruction on the check stub on behalf of Yang Hau:

ATTENTION:

Enclose Draft/Check is been sent to you from our office on behalf of Mr. Yang Hau we advice you to send e-mail to greensount@financier.com immediately after you have received this payment to notify our verification department. Failure to notify us via e-mail will render this instrument void. We prefer communication via e-mail-notification and acknowledgements of the payment received in English.*

*The examples above include the typographical and grammatical errors as they appeared on the check stubs.

Imagine how many other similar stories are out there. These stories serve as a reminder to demand funds be transmitted by wire transfer, rather than deposit of an out-of-country check, even if it is written in U.S. Dollars. In a previous story entitled "Counterfeit Checks Plague Colorado," it took 20 days before the escrow branch was notified the item was counterfeit. That is valuable time wasted working on a file that won't close and valuable market time lost by the seller.

|

|

E-mail Scams!

They have been around for a long time – the Nigerian e-mail, 419, advanced fee scams – you know the ones. The perpetrators send a random e-mail or fax stating they are from a foreign country and need assistance getting large sums of cash out of their country. All the recipient has to do is send them wiring instructions and provide some personal information. The e-mail claims the participant who assists will be compensated for his/her efforts with a flat fee or a percentage of the funds.

These scams have been around for a long time and they still exist. In this issue, we provide you with recent samples of solicitations received by our offices and direction on how to handle such requests.

Here is the first example specifically targeting escrow companies:

|

This is an official requisition for your Escrow services on behalf of Germany S.U.G. Group Co, LTD.

We are based in China and our principal activity is Supplies and manufacturing of Machineries and Tools. We have a dire need for USA liaison\receiving representative to assist us with receiving payments from our delinquent customers in USA, indebted to us in quite substantial and various amounts of monies and we request for your services accordingly.

We got your contact information from the Chamber of Commerce, in search for a reliable firm or individual to provide services as requested. After careful review of your profile, we are of the opinion that your Escrow activity is relevant to our needs. We wish to state that we are open to negotiate of your compensation/service fees. Please accept my appreciation on behalf of Germany S.U.G Group Co, LTD, In advance for your willingness to render your services and we look forward to your prompt response to our request. Please feel free to contact me, Mr. Lee Sung at my private e-mail: l_sung@ymail.com, that is first letter of my first name, underscore@ymial.com.

Thank you.

Sincerely,

Mr. Lee Sung

GERMANY S.U.G GROUP CO, LTD, CHINQA.

l_sung@ymail.com*

|

This one will pull at your heartstrings:

|

My name is Mr. Ping Chang. I work with a senior investment consultant for the DBS Capital Investment Ltd here in Hong Kong. I also work as part of the regional team that covers the entire Asian region. I had taken pains to find your contact through personal endeavors.

Approximately five years ago, an investor (Mr. Anthony – Deceased nine months ago) invested a total of US$22.5M (Twenty Two Million, five hundred thousand United State Dollars) with my department. With interest at today's value, the said invested fund is now worth a little under US$30M (Twenty Nine Million, Eight Hundred and Fifty Five Thousand United State dollars).

Late Anthony Attorney/Lawyer notified my department of the sudden death (Car Accident) of Mr. Anthony. He (the attorney) also expressed concern that Anthony had died without a will and he has no details of any surviving relatives. The lawyer has now requested my department to check our records to clarify who Late Anthony may have named as his next of Kin on the investment application, Fortunately, or rather unfortunately, the person named as next of kin, was his girl friend who also died in the car accident. I have not yet notified the lawyer that the next of Kin was the girl friend. I have a very limited time to do so.

Should I notify the lawyer of my findings, automatically, the invested funds will be confiscated by the Hong Kong Government. This I do not mind, my concerns and worries is that the funds once released from our bank, it will be diverted elsewhere by senior Hong Kong government functionaries for their personal gains. On the basis of my worried, my immediate boss and I decided to act fast by contacting and inviting you to work with us posing as a relative of the deceased, since you share the same LAST NAME as the late investor.

With our insider's privileged information, the funds can be paid to your as the only surviving relative. We have all the information and guidance to enable us realize this opportunity. We have evaluated the risk elements and we are convinced that the risk element is ZERO, as long as you maintain 100% confidentiality.

Please, again, note I am a family man, I have a wife and children. I send you this mail not without a measure of fear as to the consequences, but I know within me that nothing ventured is nothing gained and that success and riches never come easy or on a platter of gold. This is the one truth I have learned from my private banking clients. Do not betray my confidence. If we can be of one accord, we should act swiftly on this. Please get back to me immediately via e-mail: ping_chang@ymail.com or via fax at: +852-3010-9420

Yours truly

Mr. Ping Chang*

|

*The examples above include the typographical and grammatical errors as they appeared within the solicitations.

Most offices receive notices such as these via fax since the proper firewalls and spam filters have been added to e-mail accounts to prevent such e-mails from being received. So what do you do if you receive one of these? The Secret Service has this message posted to their Web site:

|

"If you have received an e-mail or fax from someone you do not know requesting your assistance in a financial transaction, such as the transfer of a large sum of money into an account, or claiming you are the next of kin to an wealthy person who has died, or the winner of some obscure lottery, DO NOT respond. These requests are typically sent through public servers via a generic "spammed" e-mail message. Usually, the sender does not yet know your personal e-mail address and is depending on you to respond. Once you reply, even to tell them you are not interested, they will often continue to e-mail you in an attempt to harass or intimidate you. If you receive an unsolicited e-mail of this nature, the best course is to simply delete the message."

|

So, if one of these requests is received via fax, do NOTHING. Throw it away. If it is received via e-mail, please do not reply to the e-mail or forward it. Simply delete it.

We have heard stories of customers being affected by these scams. Recently a mortgage broker was contacted by Juliet Komo from Cote d'Ivoire in Africa asking for assistance to relocate her recent inheritance of $10.5 million. The broker dealt with Komo and her director of international remittance, Raymond Richmond (supposedly from Banque Atlantique), for more than three weeks. They purportedly wired $1.7 million to the broker to fund a construction loan for a project in the U.S.

In his negotiations, the mortgage broker contacted his Title Officer, Brian Smith from Fidelity's San Bernardino, Calif. operation. His e-mail to Brian prompted him to simply perform a Google™ search on the names of the parties – Juliet Komo and Raymond Richmond. The search led him to the American Embassy Web site in Cote D'Ivoire which made reference to similar scams. Brian shared the information with the broker in an attempt to dissuade him from wasting any more time on a deal that would never come to fruition.

|

|