|

Identity theft is the fastest growing crime in the world. It occurs when someone uses personally identifying information, like someone else's name, Social Security number, or credit card number, without permission, to commit fraud or other crimes. Millions have become victims of this crime.

In an effort to protect consumers, federal and state regulations have been passed which require certain types of entities who gather customer non–public information as part of their business, to ensure measures are in place to protect their customers from becoming victims of this crime.

The Gramm–Leach–Bliley Financial Modernization Services Act is the federal act which affects title insurance companies and settlement agents. The Act's purpose is to:

- ensure the security and confidentiality of customer records and information;

- protect against any anticipated threats or hazards to the security or integrity of such records; and

- protect against unauthorized access to or use of such records or information which could result in substantial harm or inconvenience to any customer.

In plain English, the Act requires companies who are subject to its regulations to ensure they have the proper measures in place to protect the non–public information of its customers. Non–public information includes, but is not limited to:

- Social Security numbers

- Credit or debit card numbers

- State identification card numbers

- Driver's license numbers

- Dates of birth

How does this affect settlement agents?

Settlement agents regularly communicate with the parties to a real estate transaction via email in order to expedite a successful closing. Many of those emails contain the non–public information of the principals. In order to protect the principals, settlement agents originating emails containing non–public information in the body of the mail or within an attachment, should secure the email by encrypting its contents.

How to encrypt an email

The Company uses Voltage Security®, Inc. to send secure messages. Not all versions of Microsoft® Outlook are compatible with Voltage. If your version of Microsoft Outlook is compatible you will know by launching a new message and seeing the option to "Send Secure."

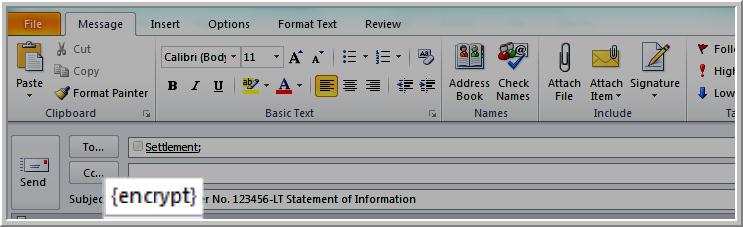

If the version of Outlook you use is not compatible, encrypting an email to make its contents secure is as easy as typing the word "encrypt" within French Brackets {encrypt} in the subject line of the email as shown below:

The email will be encrypted and sent to the recipient who will be provided a link where they will be prompted to create their SecureMailID. Once they have logged on, the message looks exactly the same to the recipient as any unsecure message.

Voltage also has a "reply secure" feature which allows the customer to respond to the initial message and add attachments which will be encrypted and sent back to the original sender. Once the email is received by the Company's network it is automatically decrypted and the employee does not have to do anything more to receive and open the email.

Step–by–step instructions are available on the Company's intranet under:

- Business Tools

- Technology

- Network and Messaging

- Email

https://home.fnf.com/technology/network_and_messaging/email.asp

Obtain written authorization

Has the customer agreed to receive emails as a part of their transaction? Do you have permission to communicate with them in this manner? If not, have them acknowledge the provision contained in your instructions or on a separate stand–alone document in your escrow production system.

Conclusion

Settlement agents must be aware of the content of their email communications. When sending non–public personal information be sure to encrypt the email. Failure to comply subjects our Company to fines under state and federal regulations. Most of all, it enables us to protect our customer's private information. Lastly, remember do not copy anyone else when sending non–public information.

|