|

Imagine sending a wire to a seller for almost $100,000 only to find out the cashier's check received from the buyer was fraudulent. That is exactly what happened to a title company and a completely unrelated independent escrow company located in different parts of the country. They were both victims of the same crime by the same criminals. Read on for more details…

An escrow manager received an email purporting to be from a longtime customer who was an attorney. The attorney regularly worked with the manager when she was an escrow officer. As far as she knew the attorney had retired.

The manager replied to her customer explaining she no longer worked on an escrow desk but would forward the request to Jane in the commercial department to see if she could assist. In her email to Jane, she explained she was referring her customer who was in need of some assistance with UCC searches.

Jane received the email and responded directly to the attorney. The attorney put Jane in touch with her client, Joe Tuesday. Jane received an email from Mr. Tuesday. Jane asked Mr. Tuesday what kind of search he was seeking. His request quickly changed.

Mr. Tuesday explained he was purchasing a recreational boat and that he needed to make a good faith deposit with an escrow agent per the written Agreement he signed with the seller. Once he performed his due diligence, the funds on deposit would be released to the account of the broker for the seller. That is all Jane would need to do.

Jane agreed to accept the transaction and prepared escrow instructions required by her state regulator. She emailed them to the buyer and seller. They signed the instructions and emailed them back to her. The buyer sent in a cashier's check for $99,500 which was deposited in the escrow trust account on March 6, 2014.

On March 13, 2014, Jane received an email from Mr. Tuesday instructing her to wire his good faith deposit to the seller's broker. Jane entered the wire into the system and sent it to her Operational Accounting Center (OAC). The OAC sent the wire on March 13, 2014 at 2:47 p.m. Forty–three minutes later (at about 3:30 p.m.) the OAC was notified the cashier's check remitted by Mr. Tuesday was a fake!

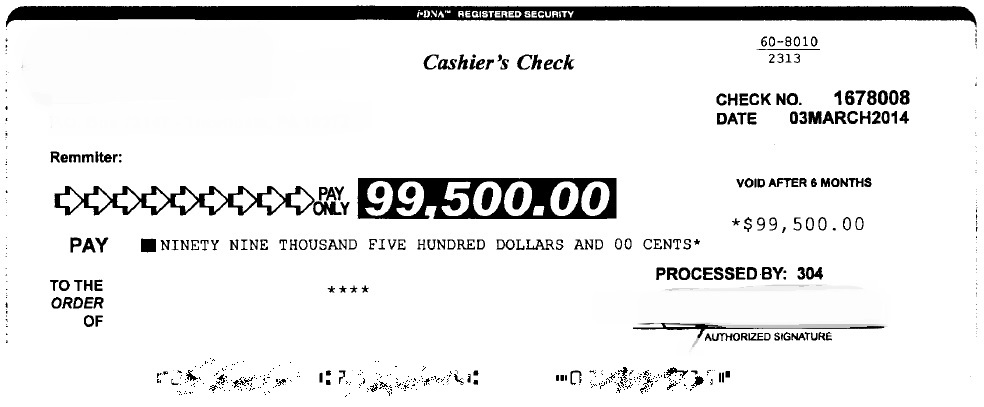

Here is a copy of the check:

As soon as the OAC received the notification, they instructed Jane to take the check to the bank and try to deposit it manually. She did. In the meantime, the OAC attempted to recall the wire. The receiving bank would not honor the request unless it was approved by the account holder.

The in–house attorney filed a lawsuit and an ex parte request for a Temporary Restraining Order, so the account holder could not drain the funds from the account. A judge approved the order and the funds were frozen. Notice was served upon the account holder who was given 30 days to respond and dispute the freeze. Failure to respond would allow the bank to return the funds to the operation.

Unfortunately, a second transaction involving the same criminals and an independent escrow company who handled the transaction were not as lucky. They were not able to respond as quickly and the funds were withdrawn before they could freeze the account.

As we wrote this article, we received notification of a third transaction from an attorney agent located in yet another state that became victim to this same crime with the same perpetrators. The attorney agent does not reconcile his trust account on a daily basis. It was only when the office performed its monthly reconciliation that they realized the shortage. More than 15 days had elapsed. The trust account was overdrawn by almost $100,000. The money was long gone.

What a scam! The perpetrators in this instance were very savvy. First off, they hacked into the email account of a reputable, but retired attorney. Since the attorney is no longer associated with a law firm she uses a Gmail™ account.

By using the attorney's reputation and email account, their request was automatically granted some legitimacy. And, it appears there is another retired attorney with the same name in one of the other states where a similar crime was committed!

Next, they sent the request to the manager of the operation purporting to be one of her longtime customers. When the manager passed the request on, Jane responded immediately in an effort to impress her boss's customer. She did not question the legitimacy of the transaction.

In this instance the seller was named as a real person with previous business ties to the state where Jane's branch was located. Her mailing address listed on the Agreement was once her legitimate mailing address. She was in no way actually involved in the transaction and had no idea her name was being used. The perpetrators set up a Gmail account in her name and sent emails purportedly from this seller to make the transaction appear even more legitimate.

Mistakes and Red Flags

Unfortunately the only communication Jane had with anyone was by email. All the parties used Gmail accounts, which can be set up by anyone using any email address. She never spoke to the buyer, seller, seller's broker or attorney who referred the customers by phone or in person.

The check contained many red flags. The MICR line was incorrect. The check number is listed first when it should be last. The ABA number is listed second when it should be listed first. Did you notice the glaring typo? The word "Remitter" on the check is misspelled.

In addition, the bank account for the operation which deposited this check is not within the same Federal Reserve District as the bank that purportedly issued this cashier's check — so the forged cashier's check took additional days to be returned as counterfeit. The thieves counted on this fact.

In this day and age we have a wealth of information right at our fingertips to verify a check. Simply searching the Internet for the issuing bank or credit union will at least reveal their contact information.

Settlement agents who are unsure about a check they receive should call the issuing institution and ask them to verify whether the instrument is valid. The bank will not verify funds are on deposit, but they can and do look at an instrument and verify whether it is valid or not.

The Agreement had poor grammar and typos in it. Here is an example:

| |

"Escrow holder will release said funds to seller upon receipt by Escrow holder of a written authorisation from buyer that he is satisfied with the inspection of said product and will complete the sale."

|

The escrow was for personal property — an expensive recreational boat. Although some operations have proper approval from management to handle floating home transactions, our Company does not handle transactions for the transfer of a recreational boat.

Settlement agents asked to handle a transaction which is out of the norm or does not include real property should only proceed with management approval which includes management approval of the parties' written agreement.

Do not assume your manager has all the facts just because they forwarded the original request to you. In this instance the manager had no idea the original request changed from a UCC search to an escrow–only for the purchase of a boat.

The last red flag was the assignment of the proceeds. Anytime a seller or borrower requests an assignment of their proceeds to another party it should be considered a big red flag. In this file the good faith deposit was sent to the seller's broker. Why? If the broker was to hold the funds, why did they need an escrow anyway? The assignment of the due diligence deposit in this instance is the only reason the scam worked.

| |

| |

MORAL OF THE STORY

In this day and age it is important to slow down and pay attention to the details. Be sure to review the checks you receive. If you are uncomfortable or unsure of a cashier's check's validity, contact the issuing bank or credit union to see if it is valid.

Do not venture outside of the normal scope of transaction types without management approval of the transaction type and any written agreements describing the services you are being asked to provide.

If you are asked to send proceeds to anyone other than a seller or borrower, ask questions to find out why. In this instance, if Jane insisted she speak directly with the seller or the seller's broker, the whole scheme might have fallen apart. It is amazing what you might uncover if you ask a few questions.

P.S. The fraudsters' real names are not used in this article. However, FNF has issued a Confidential Memorandum containing their real names.

|

|

| |

|