|

Imagine receiving a cashier's check, depositing it and three days later disbursing $45,000 against it, only to find out it was counterfeit! That is exactly what happened to an escrow officer at an abstract company in Arkansas who did not recognize the signs of a criminal act.

An Option Money Escrow Agreement is opened at an abstract company in Arkansas for the option to purchase a vacant lot in Alabama for $230,000. The Agreement is emailed in by the buyer. The subject line of the email suggests the transaction was referred by a prominent local attorney. Neither seller nor buyer is represented by a real estate agent.

According to the agreement the buyer resides in Alabama (not at the subject property); the seller resides in North Carolina. There is no provision for the purchase of an optionee title insurance policy in the agreement. The agreement calls for an initial deposit of $45,000 as option money.

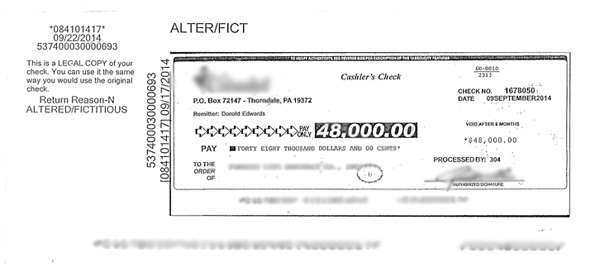

The option money is received by the abstract company via overnight delivery from the buyer on Wednesday, September 17, 2014 in the amount of $48,000, not the $45,000 as anticipated. The escrow officer notifies the seller the money has been received. Below is a copy of the cashier's check:

The agreement instructs the escrow agent to release said funds to the seller upon receipt of written authorization as follows:

| |

"Escrow holder will release said funds to seller upon receipt by Escrow holder of a written authorisation from buyer that he is satisfied with the inspection of said product and will complete the sale."

|

There are no further terms provided for the closing of the sale of the subject property. The agreement states the escrow holder's duties end once the option money is released.

The buyer sends an email to the escrow officer on Friday, September 26, 2014 stating the property inspection is complete and to release the option money to the seller. The escrow officer obtains wire information from the seller and proceeds to wire the funds to the seller's account. Everyone goes home for the weekend.

Monday morning the escrow officer arrives at work and receives notification from the bank the deposited cashier's check in the amount of $48,000 has been returned as "fictitious!" The title agent contacts the bank to recall the $45,000 wire she sent out on Friday. The trust bank contacts the receiving bank, only to discover the account has been drained to a zero balance.

Now the abstract company is faced with tracking down the seller to recover the stolen funds. The property appears to legitimately be in the seller's name, so there might be a chance the abstract company could lien the property for repayment.

DO YOU RECOGNIZE THE SIGNS?

- Unusual transaction, not involving the issuance of a title insurance policy.

- Only contact with the principals was through email.

- Email received to place the order used attorney's name in the subject line as "referral from Sarah Bender."

- No real estate agents were involved in the transaction.

- The buyer and seller picked an out–of–state abstract company to handle the closing.

- The MICR line on the check placed the sequence of numbers incorrectly as: check number + ABA routing number + account number, instead of ABA routing number + account number + check number.

- The agreement contained typographical errors.

We reported three stories containing the same tell–tale signs in the July 2014 edition. Now this is the fourth story. Pay attention to the warning signs. The same perpetrators are using the same bank's name to remit the counterfeit checks.

If you need the name of the bank or the names of the perpetrators contact the National Escrow Administration team by email at settlement@fnf.com. We will be happy to help stop this crime.

|