|

A sales transaction opened with an escrow branch for the sale of a dairy farm in the amount of $2.5 million. The buyer was from North Carolina and agreed to pay cash for the farm. The escrow officer engaged in a telephone conversation with the buyer about the amount of funds to wire. The buyer indicated he was going to "over–wire" funds to the trust account and he wanted her to just deposit the excess into his account. What? The amount of the wire changed throughout the conversation from $3.5 to $5 million.

Next, phone messages were received from the buyer that the closing funds were on hold because they were coming from out of the country and everything had to be cleared through the Patriot Act. Later, the escrow officer received emails stating the funds would be coming from Iraq. The escrow officer told the buyer and his agent she would need third–party deposit instructions from the remitter of the funds.

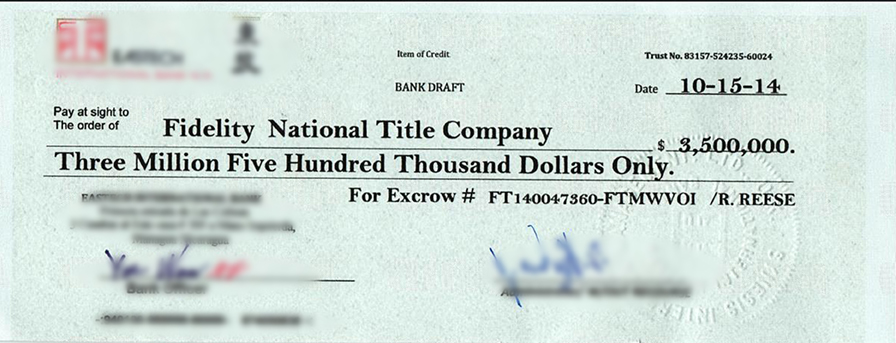

Then things turned really strange when the escrow officer received a call from the assistant to one of the sellers, wondering if she had heard anything about a bank draft sent to our Company from the buyer. The escrow officer asked the assistant if she had a copy of the bank draft. She did and forwarded it via email to the escrow officer. The bank draft was for $3.5 million from Nicaragua, not Iraq.

The escrow officer consulted management, as well as the national escrow administrators. She wanted to know if she should advise the buyer of the following:

- We ONLY want the amount of funds that we need to close; and

- We MUST HAVE WIRED FUNDS; and

- We need the contact information for the remitter, since they will need to execute third party deposit instructions.

Management and the national escrow administration team advised the escrow officer to resign as escrow holder by letter immediately and to return all documents deposited into escrow to their original remitter.

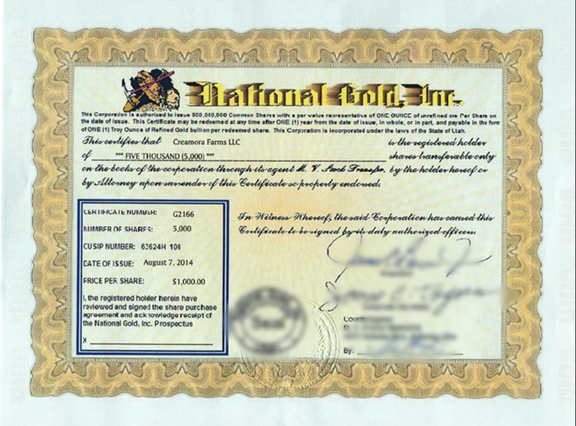

As the escrow officer was preparing the letter a courier dropped off the original bank draft and a stock certificate purportedly for 5,000 shares of gold, worth $1,000 per share. Unfortunately no one thought to refuse the package. Now the escrow officer was stuck with both!

The escrow officer, with advice from her manager, proceeded to resign from the transaction and requested an address from the buyer on where to return the bank draft and stock certificate. The buyer did not readily provide an address. The escrow officer ended up returning the documents to the address on file for the buyer.

| |

| |

MORAL OF THE STORY

I am sure you have to ask yourself…how did the deal get this far? The file was worked up with all of the title work completed and it was ready to close without the buyer putting up one cent for earnest money. The escrow was transferred from one officer to another during the process.

Both escrow officers had a "funny" feeling about the transaction, but both continued to process the transaction as if it would close. Since everyone else believed it could happen, we did too. Next time you have a deal that you get that "funny" feeling about, ask the buyer to put up funds to pay for the title work and curative work. If they are a legitimate buyer, they likely will not shy away from depositing money to be used to pay costs at closing.

| |

| |

|