|

One year has passed and the industry is still plagued with the theft of trust funds by criminals who deposit counterfeit checks, call for the immediate release of funds and have the money wired to an outside third party – an entity's account, not an individual's account.

We have reported the details of the crime in previous editions to share the red flag warnings in an attempt to halt the crime spree:

Unfortunately, the criminals have found a prime target – settlement agents – and continue to pull off their crimes to the tune of hundreds of thousands of dollars. The most gut–wrenching part of the crime is that it is completely preventable. What can you do to prevent the crime?

- Insist on speaking to the principals by a pre–established telephone number or in person before acting on their instructions; currently the people perpetuating this scheme will only communicate with settlement agents via email.

- Verify the check was validly issued by the bank by calling the issuing institution.

- Do not disburse against uncollected funds. The checks are drawn from a federal reserve outside of the depositing bank, so they take additional time to clear – or in this case be returned as counterfeit.

- Contact National Escrow Administration by email at settlement@fnf.com even if you are slightly suspicious. We can spot the crime from miles away.

- Review the purchase contract making note of different fonts and typographical errors.

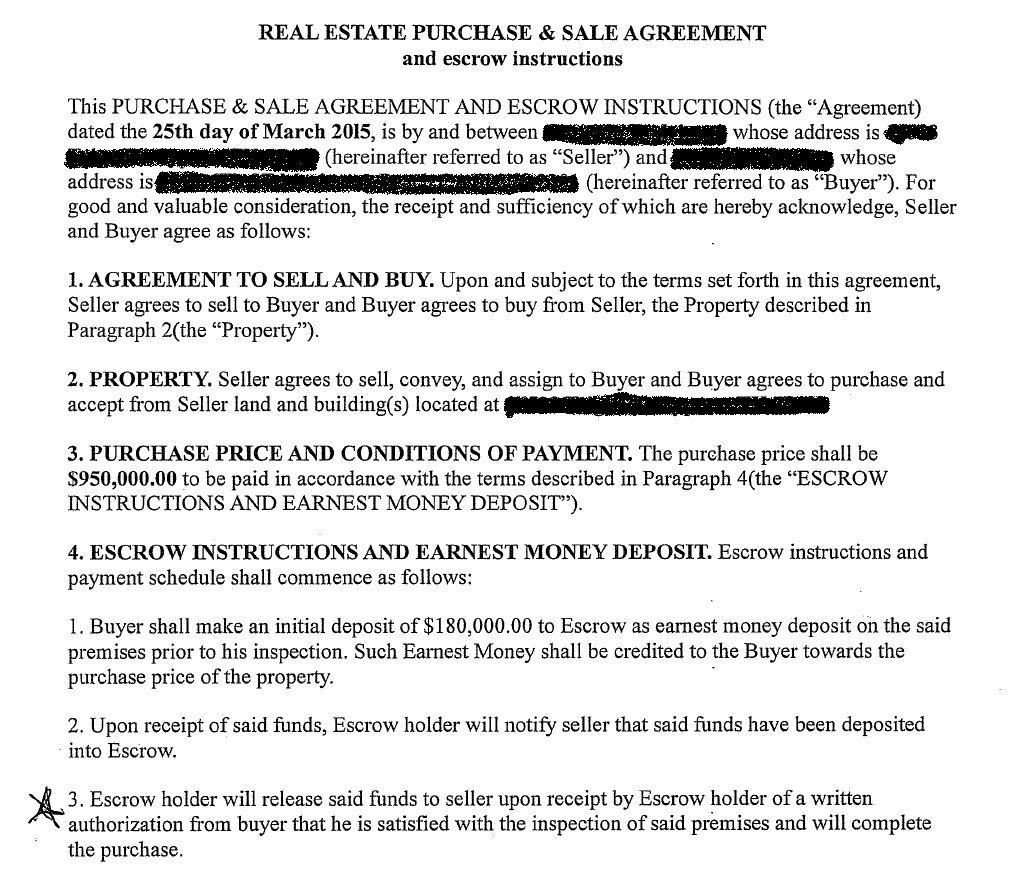

Below is an example of the purchase agreement:

If you see this agreement, immediately contact your manager and/or the National Escrow Administration department.

|