|

Liz Kalodemas, Escrow Officer at Fidelity's office in Santa Rosa, California, received a random email for escrow services, from a buyer by the name of "Darl." The email signature line indicated the message was from a Doug Jenner. Liz responded to the message asking for particulars about the transaction.

Darl responded:

| |

Attached is a copy of the purchase contract. This is a private sale and a cash transaction. I would need escrow to make a deposit, which is to be remitted to the seller as commitment, once inspection is completed. I need you to provide information on how the escrow deposit should be made out to you in certified check and also do let me know your fees/charges.

|

The contract contained a valid property owner's name and valid property address for the sale of property in the amount of $389,000. The contract called for an earnest money deposit in the amount of $69,900. The contract listed a Darrell "Smith" (not Darl) as the buyer and a David "Jones" was listed as the seller. It made no mention of a Doug Jenner.

Liz promptly opened the new escrow and ordered the title report. On July 14, 2015, Liz provided her branch address to Darl so that he could send the earnest money deposit check. On July 21, 2015, Darl emailed Liz again asking for the address of where to send the check. Liz responded immediately with her branch mailing address.

On August 10, 2015, Liz received a new email message from Darl that read:

| |

I have been away on a business trip and will not be back until next week. I have sent you the escrow deposit ($95,500) in certified funds and it should be delivered no later than August 11, 2015. Once it is received do go ahead and deposit it. Inspection has been scheduled for August 11, 2015. I will provide further update on the transaction once inspection is completed.

|

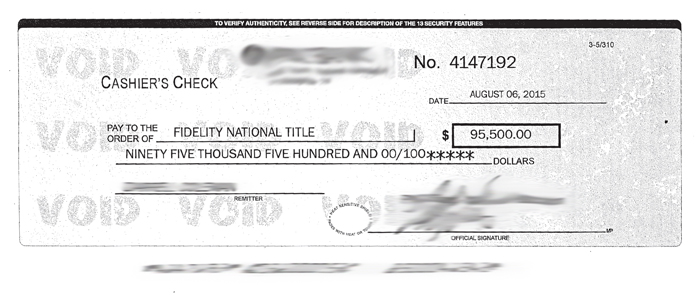

The very next day, August 11, 2015, Liz received the check via overnight delivery. It was in the amount of $95,500, not the $69,900 called for in the purchase agreement. The check referred to the remitter as Darrell, not Darl. Liz confirmed to Darl via email the check had been received and deposited into the escrow trust account. Liz requested mailing addresses for both buyer and seller.

On August 12, 2015, Darl sent the following message:

| |

Hello,

I am pleased to inform you that Inspection of the property has been completed and we are ready to proceed with the transaction. Attached to this message is the sellers remittance instructions for the deposit as stated on the purchase contract. The seller resides at the property.

|

| |

|

| |

I have informed the seller that the deposit of $69,000 will be sent as instructed by the end of business tomorrow. Do see that the wire transfer is initiated to the seller. Once the transfer is initiated do attach and send me a copy of the transfer confirmation so that I may be able to update the seller accordingly. I am looking to close as soon as possible do act swiftly to enable me secure the property so we can commence with the Title work. You can mail me Darl, P.O. Box 363, but email attachments are a lot safer and faster.

|

Darl supplied no city, state or zip code information for the mailing address. The email contained an instruction attached to it, as well as wire instructions to an account of an unrelated third party.

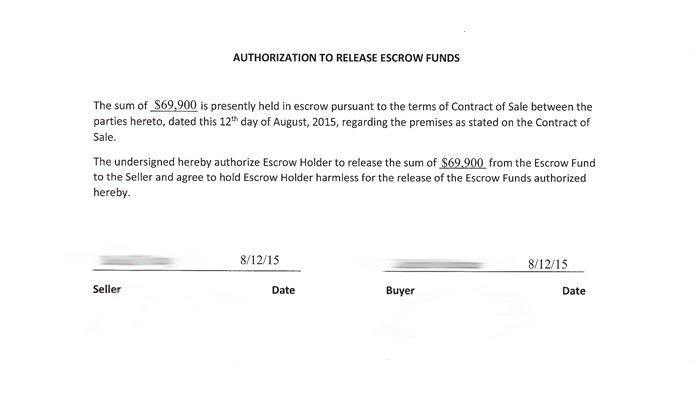

What was missing from the instruction?

The instruction made reference to a Contract of Sale — not a purchase and sale agreement. No other specifics — like the parties to the contract, date of contract and subject property — were mentioned, which would have tied the instruction back to the operative purchase and sale agreement.

The instruction did not provide clear and concise information, on where and when to remit payment. It provided no address or wire transfer information for the delivery of the funds to the seller, only to a third party.

The instruction did not provide information on whether the funds were to be applied toward the purchase price at closing. Nor did the instruction contain the hold harmless language required for the escrow holder to release funds without transferring or encumbering the subject property.

Based on that missing information, Liz recognized the instruction was insufficient to release the funds. She let Darl know she had to obtain manager approval in order to release the funds.

On August 13, 2015, Darl emailed to see if Fidelity had released the funds to the seller. On August 14, 2015, the accounting center emailed Liz to tell her the check in the amount of $95,500 had been returned as fictitious!

Liz was able to cancel her transaction and avoid a loss to the Company. Liz's years of experience and her expertise in the industry told her the instruction to release funds prior to closing were not sufficient. By refusing to release the funds without complete instructions, Liz derailed the crime.

If Liz had authorized the funds to be released immediately as demanded by Darl, the Company would have suffered a loss in the amount of $69,900. Instead, the Company rewarded Liz with $1,500 and a letter of recognition.

Liz is a two–time reward recipient. In October 2010, she received a reward and a letter of recognition for detecting false identification presented at a signing. Criminals should know she is on her game!

Recognize the signs of this scam

- No contact with the principals except through email

- No real estate agents or attorneys are involved

- The purchase and sale agreement is not a customary form

- The deposit called for in the contract is large for a residential transaction

- The check for the deposit sometimes exceeds the agreed upon deposit amount

- The contract calls for a release of funds prior to closing

- Buyer instructs funds to be released to seller before the deposit has cleared the bank

- The wire instructions are to an entity's account, not the purported seller's account

When these signs appear in a transaction, the best course of action is to involve your manager and/or contact the National Escrow Administration team for assistance at settlement@fnf.com. We will help you resign from the transaction and warn others, so the criminals do not end up opening the same order at one of the other branch offices.

|