|

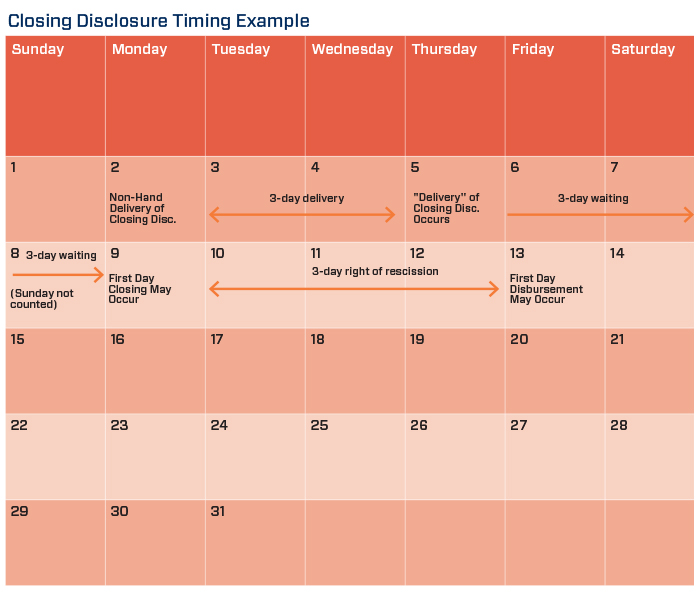

The Closing Disclosure is required to be delivered to the borrower at least three business days prior to "consummation." Consummation is defined in the new rules as the date the borrower becomes legally obligated to repay the debt, which is the date the borrower signs the note and deed of trust or mortgage.

If the Closing Disclosure is hand delivered to the borrower that would constitute day one of the waiting period. For instance, if the Closing Disclosure was handed to the borrower on a Monday, the first day the borrower would be allowed, under the rule, to sign their loan documents would be Thursday. The three day period is called the Waiting Period.

If the delivery of the Closing Disclosure is by any other means other than hand delivery, a three day Delivery Period must be added to the Waiting Period. For example, if the Closing Disclosure is emailed, mailed or sent via overnight delivery on Monday, that constitutes day one of the Delivery Period.

On Wednesday at midnight, the Delivery Period automatically expires and the Waiting Period starts. The Waiting Period would run Thursday through Saturday. The first day the borrower could sign the loan documents would be Monday.

If the loan is a residential refinance and subject to a rescission period, the rescission period is not counted the same as the Delivery and Waiting Periods. Under the Truth–in–Lending Act (TILA), the rescission period does not start until after midnight of the date the borrowers each receive two copies of their Right to Rescind. In this example, the rescission period would run Tuesday through Thursday, and the first day the loan proceeds could be disbursed would be Friday.

|