|

When the buyer's real estate agent opened the transaction with Chicago Title in Las Vegas, the escrow officer emailed wiring instructions to the selling agent. The selling agent forwarded them on to the buyer, who wired their earnest money deposit in the amount of $200,000 to Chicago Title. The transaction was moving along when the selling agent received this email purportedly from the listing agent:

| |

An additional deposit of $150,200.00 is required by the Title this morning. The funds will be deducted from the balance due at closing and it is refundable. Personally I think if this can be done today it will be perfect, that is of–course if funds are available now, Please advice if funds can be wired today, if not please advice when this can be done so i can update all relevant parties, i will be having series of meetings today hence i will not be able to pick calls, but leave me an email if you have any questions and i will get back to you ASAP. All relevant parties to this contract are aware of this additional deposit & it will be noted in the contract as per closing.

|

| |

|

| |

Attached are wiring instructions. Confirm the receipt of the wiring instructions and send the proof of wire to me once done so we can update our files.

|

The selling agent was confused, at first. He was confused because the buyer never agreed to an additional deposit. Then the real estate agent looked closer and realized the email was from an email address that looked similar to, but was not, the listing agent's email. That explained the typos and poor grammar. The email came from john.johndoe@gmail.com.

The signature line contained the real email address and contact information of the listing agent; not the email address the email came from.

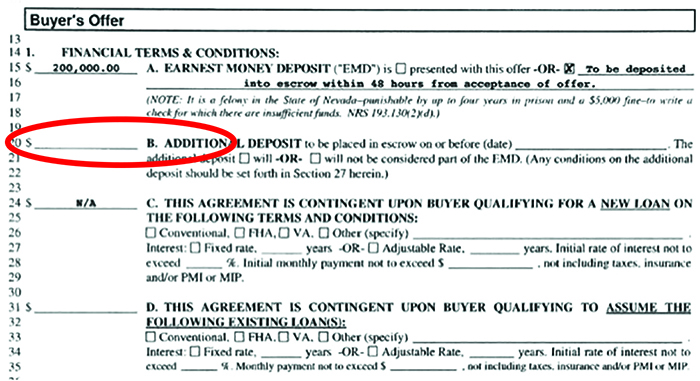

Next the selling agent looked at the purchase agreement and discovered the fraudster had altered it. The fully executed purchase agreement looked like this:

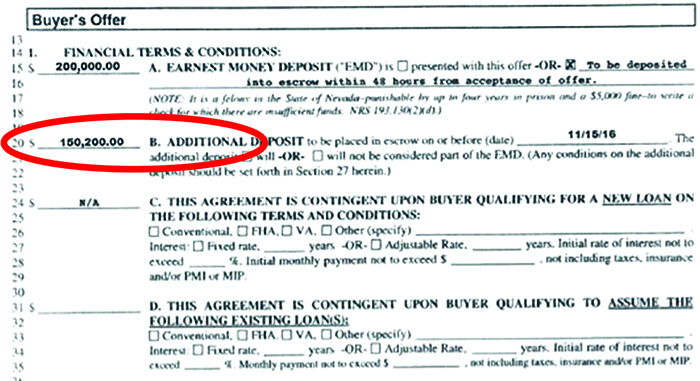

The altered purchase agreement looked like this:

Fortunately, everyone involved in the transaction knew the purchase agreement was altered and no one relied on the wire instructions sent by the fraudster, which also looked very suspicious. The real estate agent recognized the account name should be Chicago Title and not a LLD.

In this example the fraudsters modified the purchase agreement and tried to tell the buyer an additional deposit of $150,200 was due — even though the buyer did not agree to the additional deposit. Fortunately the real estate agents knew the email was a scam and notified everyone involved.

In a separate transaction, an escrow officer from Ticor Title in Reno, Nevada, emailed wire transfer instructions to the buyer's real estate agent. The agent forwarded the wire instructions to the buyer. The buyer called the Ticor escrow officer to discuss the instructions because the set he received did not make sense. They read, in part:

|

FUND ABOVE $10,000

|

Ticor Main

Bank of XXXXXXXXX

35 W. Napa Street

Sonoma, CA 95476

Routing No. XXXXXXXXX

Account Name: Ticor Custom Gates, Inc.

Account No. XXXXXXXXXXXXX

|

FUND BELOW $10,000

|

Reno Main

XXXXXXXXX Bank

535 Westminster Mall

Westminster, CA 92683

ABA No. XXXXXXXXX

Ticor Title of Nevada, Inc.

Escrow Trust Account

Account No. XXXXXXXXXXXXXXX

Reference Escrow No. 01606550

|

The buyer needed to wire transfer $230,388.34 in order to close his transaction and was puzzled as to which account to send the money. He contacted the escrow officer by telephone.

The wire instructions she sent did not contain the banking information or instructions for "fund above $10,000." Apparently, the person who intercepted the wire instructions and altered them in an attempt to divert the buyer's down payment and closing costs, was not interested in receiving any amounts less than $10,000, because their instructions directed "fund below $10,000" to the correct account for Ticor Title.

|