|

Check cashing centers offer people an alternative to traditional banking methods. They serve a certain clientele who typically have reasons they cannot deal with banks, such as credit issues or problems with a previous bank account. People who cannot provide proper documentation to open a bank account utilize check cashing facilities.

Check cashing facilities cash checks after taking a percentage of the check in exchange for providing the service. They serve a purpose for the portion of the population who need their services. Unfortunately, some people utilize a check cashing center in an effort to get away with fraud.

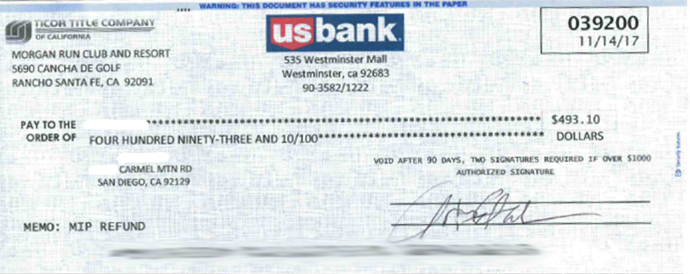

A woman went into a check cashing center to cash this check:

The check cashing center was suspicious right away. At first glance, they felt the check was not legitimate. They took the check and a copy of the payee's driver's license, and instructed her to come back the next day for her cash.

The check cashing center did an internet search for Ticor Title Company and found contact information for Carrie Haynes, San Diego County Escrow Administrator. They called her to verify the check.

Carrie did everything right. She took their call, asked them to send her a copy of the check and verified the check was not a valid issue. The check cashing center thanked Carrie for her time and that was it.

This is an example of just one of many scams involving fraudulent checks using one of our Companies names or bank accounts. Any time a check cashing center calls to verify a check, always take their call and ask them to send a copy of the check. In most instances, just like this one, simply looking at the check identifies it as an obvious fake.

This article was provided by contributing author, Diana Hoffman.

|