|

In certain markets, such as Southern California and Washington State, independent escrow agents handle real estate closings. They order the title insurance from a title insurance company that has a sub escrow division to process payments for any lien related items. These divisions pay off any existing mortgages as a part of the services they provide.

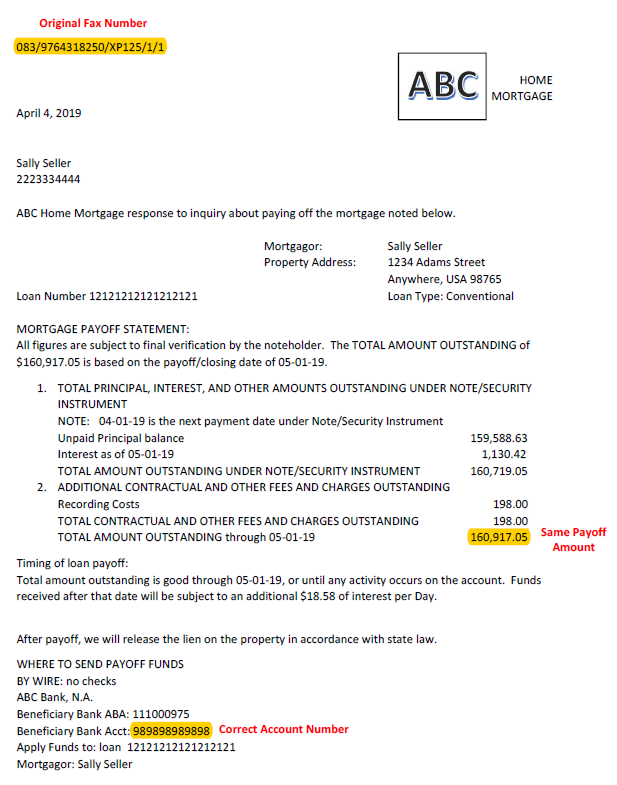

The payoff demand is ordered by the escrow agent, who provides it to the sub escrow officer. The sub escrow officer scrutinizes the payoff demand and compares the wire instructions to the Company's known trusted wire instructions. This is exactly what Wendy Troxell, Accounting Administrator with Ticor Title in Riverside, California, did.

Wendy immediately noticed the account number was not the same account number the Company wires payoff funds to hundreds of times every month. She picked up the phone to call the bank; it was confirmed the account number was not valid in any way. She asked them if the other, known number she had was the correct account number and it was confirmed it was.

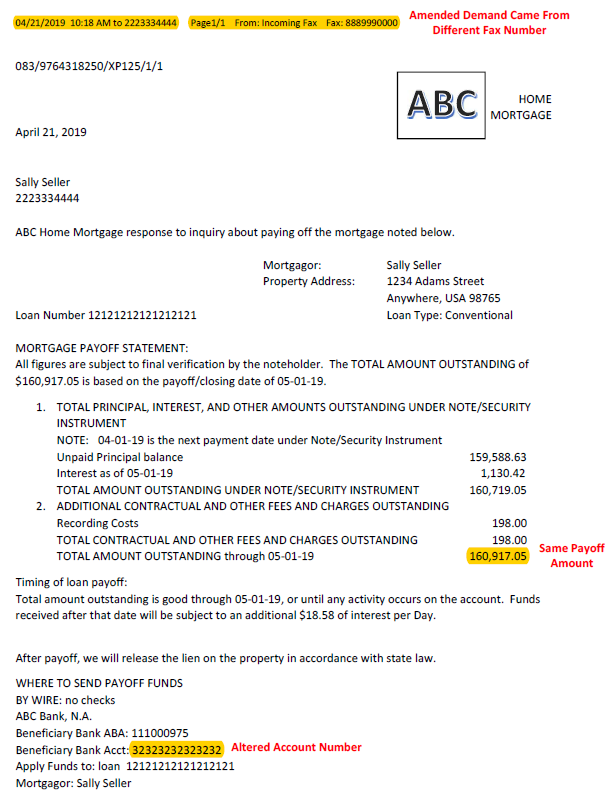

Wendy reached out to the independent escrow agent who confirmed they ordered a payoff demand at the beginning of April 2019. Then, about 20 days later a revised demand was received via eFax.

Wendy asked why an update to the demand had been ordered, since the amounts did not change. The escrow agent told Wendy she never ordered the update, it just showed up. Let's compare the two:

The highlighted information in the two letters is listed below for readability.

|

|

ORIGINAL DEMAND

|

AMENDED DEMAND

|

|

Fax Number

|

083/9764318250/XP125/1/1

|

888999000 (different)

|

|

Payoff Amount

|

$160,917.05

|

$160,917.05 (same amount)

|

|

Account Number

|

989898989898

|

32323232323232 (altered)

|

Wendy notified her manager, Chad Finn, of her findings. Chad alerted the escrow agent that someone's email account had been compromised. He suggested they have their systems checked.

The escrow agent called back a few days later. It turns out, they had been communicating with the fraudster all along. The fraudster was intercepting emails between the real estate agent and escrow agent for several days, and responding as if he/she were the real estate agent.

The independent escrow agent had no idea fraudsters were intercepting payoff demands and altering them. They were shocked to discover eFax is an unsecure method to transmit payoff demands. The independent escrow agent reported the incident and is working with law enforcement to prevent falling victim in the future.

Every time we think we have the swindle figured out, the fraudsters tweak it just enough to conceal it. The escrow agent even uses this as their email tagline:

***CAUTION: EMAIL FRAUD CONTAINING INCORRECT WIRE INSTRUCTIONS. If you receive an email requesting you to wire funds to ESCROW CALL YOUR ESCROW OFFICER IMMEDIATELY to verify the information prior to sending Funds.***

Thanks to Wendy and Chad, the escrow company knows what else they need to look for. Chad nominated Wendy for a $1,500 reward for taking the time to review the payoff thoroughly and prevent the Company from becoming a victim. We agree she is deserving of the reward and recognition for her efforts. Congratulations Wendy!

|