|

Imagine setting a goal of buying a home. For many, this means sacrificing for years to save enough for the down payment. The buyers find their dream home. They make an offer to purchase the home, the offer is accepted, and the escrow and title order is opened with a title company. The settlement agent sends an email to the buyer similar to this:

|

From: Officer, Starrsofficer@fntg.com

Sent: Monday, January 1, 1019 2:52 PM CT

To: Doe, John (Buyer)jdoe@yahoo.com

Subject: Document Delivery Notice - Order # 56565656 Ref

Good Afternoon,

Due to the continued rise in wire fraud we now require the attached alert to be signed and returned back to Fidelity National Title Group. Please read it in its entirety to help prevent wire fraud in our transaction.

Please do not wire your closing funds before verbally verifying wiring instructions with an employee of Fidelity National Title Group.

Please do not hesitate to contact Fidelity National Title Group with any questions or concerns.

Thanks you!!!

Starr Officer

Fidelity National Title Group

|

Here are a few excerpts from the alert:

WIRE FRAUD ALERT

IMPORTANT! YOUR FUNDS MAY BE AT RISK

|

Please be advised that the wire instructions listed below are the only wire instructions that we will send you. This is the only form that should be used to wire finds to us in this transaction. If you receive another email or unsolicited call purporting to alter these instructions, please immediately call us at: 888-934-3354

|

BANK NAME: Large Bank, N.A.

ADDRESS: 1234 Everywhere, Anytown, USA, 11223

|

| ABA NO: 090909090909 | ACCOUNT NO: 987654321 |

| ACCOUNT HOLDER: Fidelity National Title Group | REFERENCE: 1212121212 |

The transaction progresses. The closing date is only a few days away when the settlement agent sends an estimated closing statement along with the same wire instructions illustrated above.

The settlement agent calls the buyer, at a known trusted phone number to review the wire instructions and confirm he agrees to the amounts reflected on the closing statement. At the end of the conversation, the settlement agent reminds the buyer the wire instructions will never change.

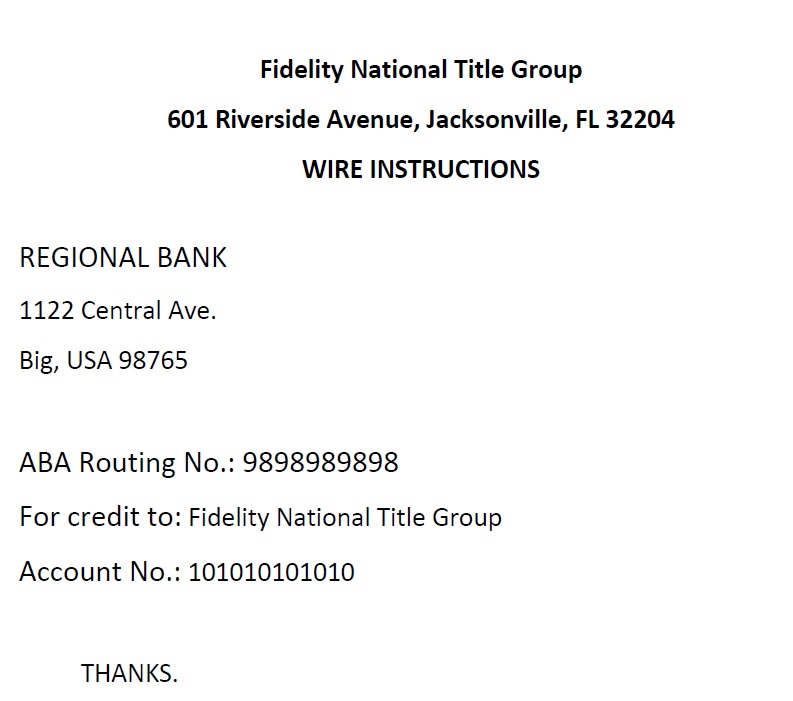

The next morning the buyer receives an email from someone whom he believes is the settlement agent, stating something has gone awry with the Company's bank account and provides him with new wiring instructions. He prints off the new instructions, goes to his bank and initiates a wire.

Two days later the buyer goes to the title company to sign his closing documents. The settlement agent asks him when he will be wiring in his down payment and closing costs.

That is when the buyer's stomach does a few flips and he instantly recalls all of her warnings. He tells her he sent the wire a couple of days ago. She asks him where he sent the funds. He pulled out the wiring instructions shown here:

The settlement agent confirms they are wrong and shows him the correct ones. She tells the buyer to go to his bank right away and request they recall the wire for fraudulent reasons. He leaves.

This is an all too common story. Buyers all over the country are losing $50,000, $100,000, $500,000 or more, to fraudsters posing as someone in a real estate transaction and providing the buyer with alternate wire instructions. This crime is devastating.

Everyone gets harmed by this scam. Sellers lose the buyer of their home. Real estate agents lose their commission. Lenders and settlement agents cannot close their files. Worst of all, buyers lose their lifesavings!

How can we stop it? By working together. Talk about the scam. Discuss how it works and how it can be prevented. Share this article with anyone and everyone you know who may just be thinking of buying a home.

Tell homebuyers wire fraud is real and they are one of the biggest targets. Give them these four steps to avoid being a victim:

- Call, do not email: Confirm all wiring instructions by phone before transferring funds. Use the phone number from the title company's website or a business card.

- Be suspicious: It is not common for title companies to change wiring instructions and payment information.

- Confirm it all: Ask your bank to confirm not just the account number, but also the name on the account, before sending a wire.

- Verify immediately: Call the title company to confirm the funds were received.

By working together and getting the word out we can help stop the hackers from succeeding at this crime.

Article provided by contributing author:

Diana Hoffman, Corporate Escrow Administrator

Fidelity National Title Group

National Escrow Administration

|