|

Fraudsters work hard to conceal their identity and have found ways to insert themselves into every step of the real estate process. They make last minute changes to keep the victim or settlement agent unaware that wiring instructions have been tampered.

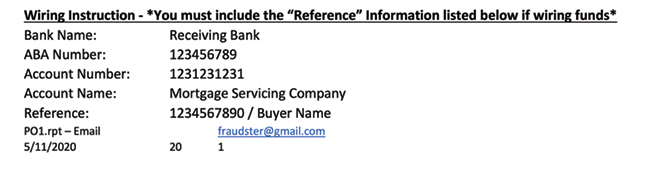

Our employees, however, have become more vigilant and aware of the fraud. Sandee Dhanowa, a processor for Lawyers Title Company, works in the payoff department. She performed a second review of wiring instructions before processing a payoff wire, partially shown below:

Comparing these instructions to any other demand from the same company would reveal nothing suspicious. The letter format, text, font and appearance were identical. The remainder of the payoff statement was completely unmodified.

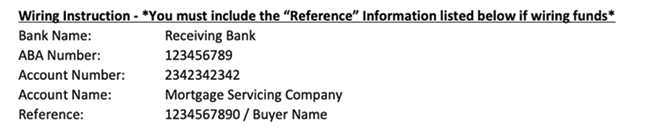

However, Sandee never strayed from Company policy. She compared the account number to the known and verified mortgage servicer instructions and discovered the account number was not a verified account number for payoffs.

The escrow was being handled by an independent escrow agent. Sandee requested they obtain another demand from the mortgage servicing company. Comparing her first documents to the new, unaltered payoff statement seen below, there was little to distinguish them apart — except for two items. The first exception was the account number.

The second exception was the email address that was added to the altered instructions. All the other information appears in the same order as the valid, unaltered payoff. The account name and routing number are all the same.

Realizing the instructions had been modified Sandee alerted the independent escrow agent, providing advice on how to communicate moving forward. Her actions ultimately saved the Company and our customers from a major headache and a potential loss of $346,714.47.

Fraudsters continue to try and lull our busy industry to sleep by making the least amount of changes possible. Double checking our work will only strengthen our defense against fraudsters. Moreover, remaining on red alert for all wired funds is a must, no matter how trivial the wiring instructions may seem.

Sandee prevented a potential loss by spotting a small change only recognizable by a watchful and attentive approach. For her efforts, the Company is awarding her $1,500.

Article provided by contributing author:

Scott Cummins, Advisory Director

Fidelity National Title Group

National Escrow Administration

|