|

Escrow and title companies are still under attack, fraud is being perpetrated from all angles of the transaction. As a result, our operations are taking their time and extra care to thoroughly review checks; our operations need to ensure funds are unconditionally collected before closing and disbursing.

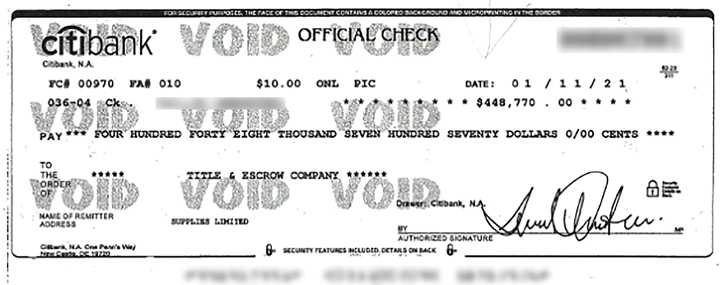

Western Title & Escrow Company received an "Official Check" drawn on an institutional bank. Tara Thompson, Branch Manager, and Ellen Frank Chapman, Escrow Administrator, were on high alert. The transaction consisted of many red flags the Company had seen before.

✓Cash purchase

✓Payment is made by official or cashier's check

✓No earnest money deposited

✓Quick close

✓Foreign buyer, purchasing the property sight unseen

✓Only communication with the buyer has been by email

The buyer had been instructed to wire his closing funds but sent an Official Check instead. To top it all off, the remitter was a third-party company, not the buyer. Tara and Ellen notified the real estate agents the deal would not be able to close by the scheduled date. The agents put an addendum to the purchase agreement together to extend the closing date.

Tara and Ellen worked to verify the validity of the check. They contacted a Citibank® representative who said the company was unable to verify the check without the account holder on the line.

Tara and Ellen knew they needed a quick answer, so they did more digging and found a Citibank client support phone number. They called 866.678.0088, an automated system where the caller can enter a Citibank check number and the amount of a cashier's check or official check to verify whether their system recognizes it or not. The system did not recognize this check.

Next, Tara and Ellan searched the internet for a website of the company that remitted the funds. Their search was a dead end. They could not find the company online — which was enough evidence for Tara and Ellen to instruct the escrow officer to resign from the transaction.

Tara and Ellen made the right call. No one, not the real estate agents, escrow officer, title officer nor the seller, needed to keep working towards a closing. Instead, this enabled the property to be put back on the market and sold to a legitimate buyer. Turns out the Citibank automated check verification was correct: the check was later confirmed as fraudulent.

Tara and Ellen did not back down and protected the Company from a potential loss. Their research stopped the fraudster dead in his tracks. The silver lining is the discovery of the toll-free number for verifying Citibank checks. For their efforts, they are splitting the $1,500 reward. Thanks for sharing ladies!

Article provided by contributing author:

Diana Hoffman, Corporate Escrow Administrator

Fidelity National Title Group

National Escrow Administration

|