|

The transaction was a refinance. The lender for the existing loan being paid off as a result of the refinance was a private lender. The new loan was scheduled to close in just one week. The escrow officer made a payoff demand to the private lender which was received that same day.

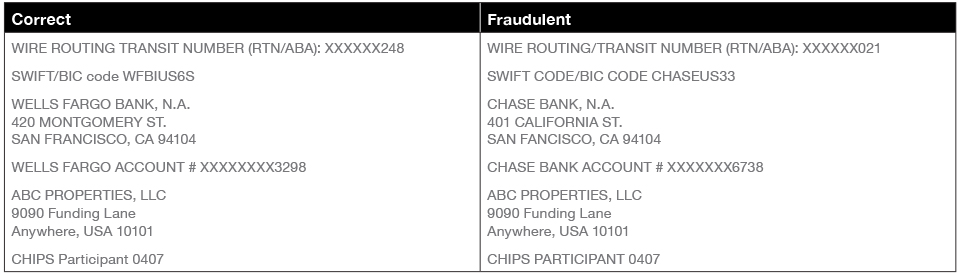

The next day, however, the escrow officer received a new payoff demand. Shannon Snead Cabe, Escrow Officer for Chicago Title in Charlotte, North Carolina, compared the two side-by-side. She noticed the payoff numbers were the same, but the contact information and wire instructions had changed.

It appeared that both payoff letters were provided by the managing member of the private lender. However, the phone numbers were completely different. Not even the area code was the same. In addition, the email addresses on each demand did not match. They were not even similar. Shannon also thought the message from the managing member was odd:

John,

Ensure that you added it to the file,and put a note on the file for your funding/post-closing department for proper funding to Chase account ending in 7519.

I'd appreciate you adding the title to this conversation for them to be aware of the recent changes on the payoff statement. I have also attached the updated payoff statement and wire instructions.

Fax was sent. Feel free to email me anytime if you have questions. I'm always happy to help.

Please confirm receipt of this email.

Thank you in advance!

Here is a side-by-side comparison of the wire instructions:

Shannon tried to verify the managing member's contact information through a trusted known source but was unable to find any information using the secretary of state's website. She reached out to the loan officer for help. Shannon explained what occurred and why she needed to confirm the contact information and wire instructions with the private lender.

Shannon also discussed the possibility that someone's email account may have been compromised in some way. She asked the loan officer to communicate with her going forward only by phone at her known office number.

The loan officer then reached out to the borrower at a known trusted phone number. The borrower described a phone call he recently had with someone claiming to be the managing member of the private lender.

The borrower said he became suspicious and started asking the gentleman who called him specific questions about the loan. The person on the phone was unable to answer simple questions — revealing he was an imposter. This information seemed to indicate that the second payoff demand the loan officer received was fraudulent.

Since then, the borrower, loan officer and escrow officer were able to talk to the real managing member and the file has been rescheduled for closing. Shannon took the time to stop, concentrate and observe the discrepancies. Her thorough review saved the Company from a potential loss. She is being rewarded $1,500 for her efforts.

Article provided by contributing author:

Diana Hoffman, Corporate Escrow Administrator

Fidelity National Title Group

National Escrow Administration

|