|

Every Rhode Island property buyer is liable for the amount withheld (or required to be withheld) and the amount shall, until paid, constitute a lien on the property purchased. The lien is subordinate to any mortgage of any lender other than a seller carryback. Filing and paying the amount of withholding due will automatically discharge the lien.

To prove residency, a seller must complete the Seller's Residency Affidavit indicating at the date of the closing, they are a resident. Corporations incorporated in the state of Rhode Island or authorized by the Secretary of State or Board of Bank Incorporation to do business in Rhode Island, are exempt from the withholding tax and would also complete the Seller's Residency Affidavit.

The buyer may rely on the affidavit only if it is notarized and signed under penalties of perjury. A recitation of the seller's residency may be contained on the deed which will discharge the lien state law imposes to secure payment of the withholding when due.

When withholding is due, the seller completes the Nonresident Seller of Real Estate Election to Have Withholding Based on Gain form and files it with the state 20 days prior to closing — otherwise withholding will be based on net proceeds at the time of the sale. The state will issue a Certificate of Withholding indicating the amount to withhold.

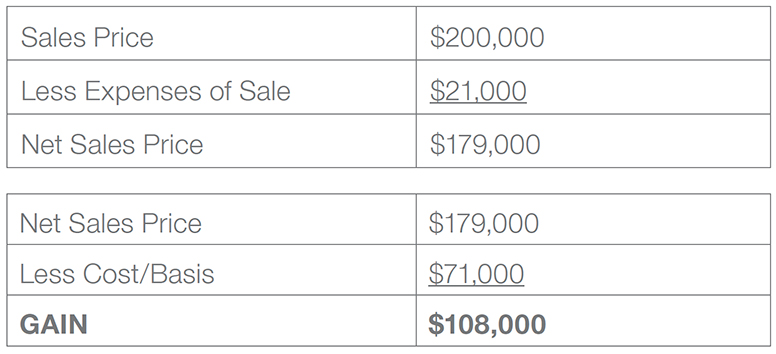

Here is an example of how the gain method is calculated:

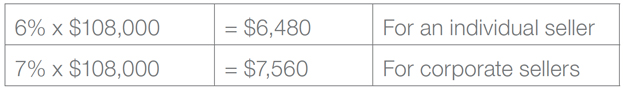

Based on these numbers the withholding rate is:

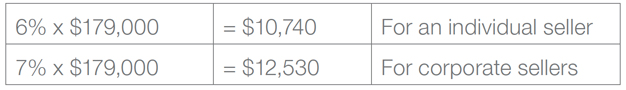

Failure to obtain a Certificate of Withholding would result in the withholding being deducted from the net sales price at a withholding rate of:

Clearly it is to the seller's advantage to apply for the Certificate prior to closing!

The buyer must remit the withholding and appropriate forms to the Rhode Island Division of Taxation within three (3) banking days after the date of closing. Late payments will incur interest, which will be added to the amount due. Paying the withholding will automatically discharge the lien. Buyers, however, can request an acknowledgement of the lien discharge for their records by completing the reverse side of the remittance form and providing a pre-addressed envelope.

These regulations are available on the Division of Taxation's Income Tax Section website www.tax.ri.gov or by phone at 401.574.8829, Option #4.

The information provided herein does not, and is not intended to, constitute legal advice; instead, all information, and content, in this article are for general informational purposes only. Information in this article may not constitute the most up-to-date legal or other information. This article contains links to other third-party websites. Such links are only for the convenience of the reader, user or browser; Fidelity National Title Group does not recommend or endorse the contents of the third-party sites.

Article provided by contributing author:

Diana Hoffman, Corporate Escrow Administrator

Fidelity National Title Group

National Escrow Administration

|