|

Michelle Lopez, an extraordinary escrow officer for Chicago Title Company's Glendale, California office, was working on a refinance. The new loan amount was $355,000. She ordered the payoff demand, sent it off to the loan officer and set the file aside for closing.

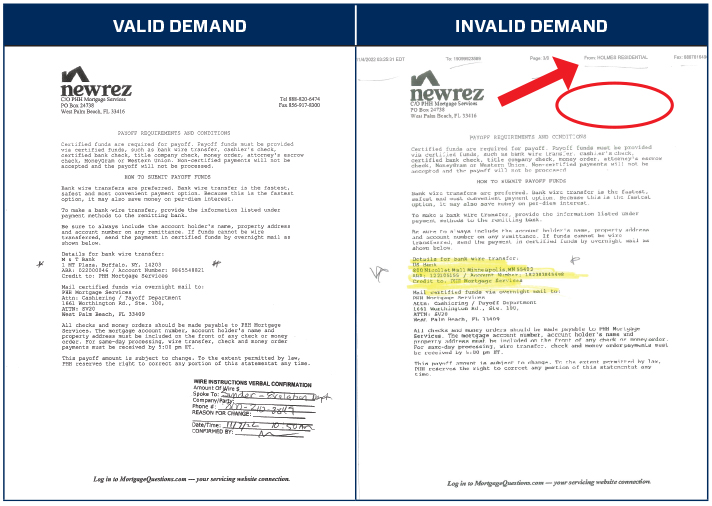

Several weeks later the loan was ready to close. Michelle ordered an updated demand. She received two demands by e-fax. Both demands were for the exact same amount, so she reviewed them side-by-side to determine why she received two.

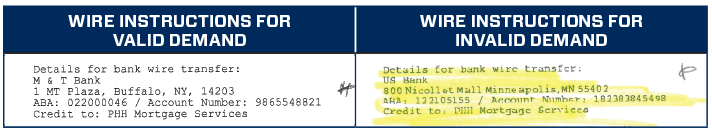

Michelle noticed at the top of one it was faxed over from a company she was not familiar with nor were they a party to her refinance. The phone numbers in the header of the demand were also missing. Then she compared the wire instructions:

Michelle knew right away someone was trying to defraud the Company. She called the lender at a known, trusted phone number and spoke with someone in the escalation department to confirm the wire instructions shown on the second demand were incorrect. She did exactly what she learned. Calling to verify the wire instructions at a known, trusted phone number is the best way to prevent wire fraud from happening.

Michelle successfully closed the refinance and paid off the borrower's loan in the amount of $197,500. Thank goodness she stopped to carefully review the demands received. She has received a reward of $1,500 for protecting the Company from a potential loss.

Article provided by contributing author:

Diana Hoffman, Corporate Escrow Administrator

Fidelity National Title Group

National Escrow Administration

|