|

Don Escusa, Payoff Processor for Lawyers Title Company in Burbank, California, was preparing to pay off a loan to clear title. The loan servicer on the loan was Freedom Mortgage. He reviewed the demand and verified it was a loan secured against the property which was the subject of the file he was working on. He confirmed the borrower's name matched the principal in his transaction.

Don reviewed the wire instructions. As a payoff processor, he is familiar with many of the loan servicer's wire instructions and noticed right away the bank listed on the demand was not the usual bank nor was the phone number shown on the demand. He compared the wire instructions on the demand against the repetitive wire list. The bank, account number and ABA number did not match.

Next, Don called Freedom Mortgage, at a known, trusted phone number and confirmed the wire instructions were not correct.

Don escalated the demand to his manager. They reached out to the independent escrow officer for more information. She explained she received two different payoff demands.

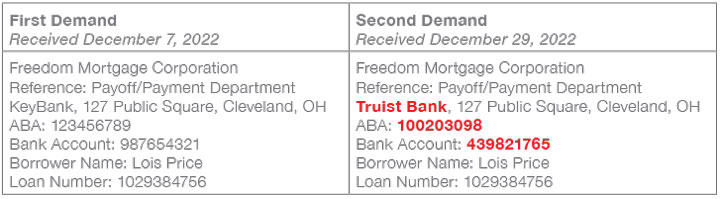

The first payoff demand was emailed to the independent escrow officer from Freedom Mortgage. The second one came a month later, but it came by fax. The independent escrow officer forwarded the revised demand to Lawyers Title.

Below are the demands side-by-side:

Here is the email which included the initial, valid demand:

This was the letterhead the demand came on:

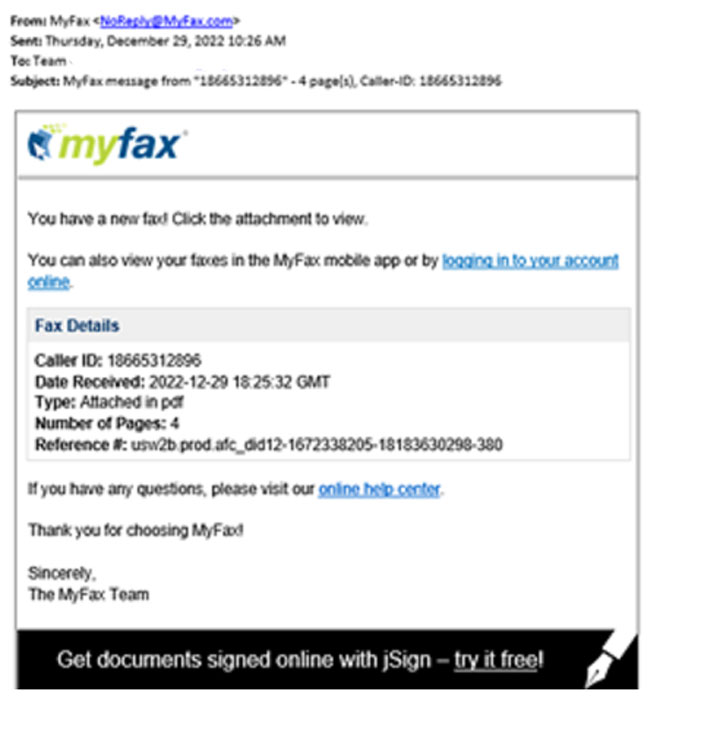

Here is the invalid demand, sent by fax:

This is the letterhead for the invalid demand:

Don did not know two different demands had been received nor did he know anything about how the demands were received by escrow. He simply followed the standard operating procedures which have proved to be tried and true.

Not only did Don protect the Company from a potential loss of nearly $500,000, he also shared his findings so others could be aware of the latest tactics being used. To show the Company's gratitude, he has received $1,500.

The methods the fraudsters use vary from one instance to another, which is why we continue to publish these stories. It is the best way to ensure everyone knows the latest tactics being used.

Article provided by contributing author:

Diana Hoffman, Corporate Escrow Administrator

Fidelity National Title Group National

Escrow Administration

|