|

As mentioned in the September 2023 edition, Form 8300 is made up of four parts. Refer to the form’s instructions to ensure it is completed correctly.

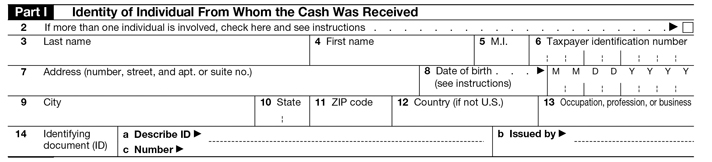

In Part I, enter the name and other identifying information of the person from whom the cash was received. In Item 6, enter their U.S. Taxpayer Identification Number (TIN). Their occupation is entered in Item 13 and the type of identifying document, along with the number and who issued the ID, is entered in Item 14.

Use Part I on the form’s second page (top of page) if more than one individual provided cash.

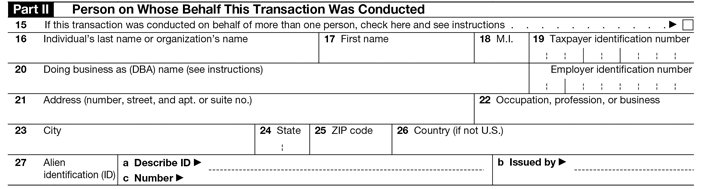

If the funds were deposited by a third party or someone other than the buyer, complete Part II with the principal’s name and information. In most instances, this will be the buyer’s name and other identifying information.

Use Part II on the form’s second page (middle of the page) to add additional principals.

Do not complete Part II if the person or persons named in Part I remitted the funds on their own behalf.

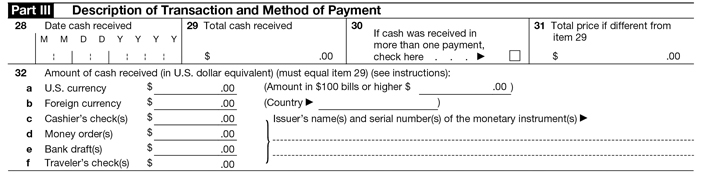

To complete Part III, refer to the IRS instructions. In Item 32 write the check or money order number of each “cash” item received. Do not include any other information, such as a copy of the receipt. If the “cash” received is actual coin or currency, do not accept this form of payment. It is FNF’s policy to not accept actual coin or currency.

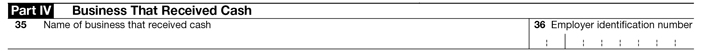

In Part IV, complete the name of the company, branch address and the company’s Employer Identification Number which received the “cash.” If you do not know the Employer Identification Number, contact your Operational Accounting Center (OAC). The settlement agent responsible for the transaction may sign the form and remit it.

Be sure to send the form to the IRS within 15 days of receipt of the cash by some traceable means. The IRS requires the filer to keep a copy of the form and supporting documentation (such as the ID and W-9) for five years. If, after you have reported the cash, the payer makes additional “cash” deposits that once again exceed $10,000, you will need to file another Form 8300 for the later deposits.

The information provided herein does not, and is not intended to, constitute legal advice; instead, all information, and content, in this article are for general informational purposes only. Information in this article may not constitute the most up-to-date legal or other information.

Article provided by contributing author:

Diana Hoffman, Corporate Escrow Administrator

Fidelity National Title Group

National Escrow Administration

|