|

|

At a title company around the corner, an escrow officer received an email from an unknown party requesting escrow and title services. The email had been sent on Sunday morning and reviewed by the escrow officer on Monday, August 21, 2023.

A purchase and sale agreement came attached to the email request reflecting a sale price of $2,175,000. The purchase and sale agreement stated it would be an all-cash offer with a required earnest money deposit in the amount of $217,500. The agreement called for a 90-day closing.

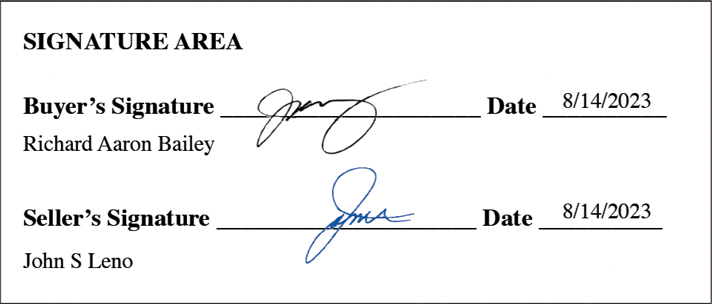

It appeared the seller’s and buyer’s signatures were completed by the same person and the signer did not even attempt to forge the names.

On Tuesday, August 22, 2023, a title report was ordered by the escrow officer and an escrow number was emailed to the buyer affirming that escrow and title services would be provided.

On Tuesday, August 29, 2023, the earnest money check arrived; it was an official check drawn from a bank in Canada. The escrow officer informed the buyer that the check would have to be replaced, since he was unable to deposit checks drawn from a foreign bank. The escrow officer returned the check to the buyer who provided a Canadian mailing address.

On Tuesday, September 12, 2023, a new official check arrived via overnight delivery drawn from 1st Bank. The check was deposited on Wednesday, September 13, 2023.

On that same day (Wednesday, September 13, 2023), the escrow officer was notified through a chain of emails between the buyer and seller that the transaction was cancelled. A Termination of Purchase Agreement was attached to the email containing the same two signatures as the purchase and sale agreement.

According to the termination, the seller agreed to release the deposit back to the buyer. The emails were all sent in the middle of the night, so the escrow officer did not read them until Wednesday, September 14, 2023.

In the emails, the buyer demanded a return of the earnest money deposit via wire transfer to a bank different from 1st Bank. The wire transfer instructions required the funds be sent to Teller Systems, Inc., which did not match the buyer’s name. On Thursday, September 14, 2023, the funds were wired out to Teller Systems, Inc., less $200 retained by the title company for fees.

On the morning of Friday, September 15, 2023, the bank contacted the accounting center at the title company to let them know the official check in the amount of $217,500 had been returned as fictitious.

The message from the bank did not make it to the escrow officer until 11:42 a.m. that day. A recall was immediately placed on the wire transfer, but it was too late. The account holder had already syphoned off the funds before the crime was discovered.

| |

| |

MORAL OF THE STORY

The escrow officer should have recognized the scam when the earnest money was tendered drawn from a Canadian bank. This transaction had all the same characteristics of the scam which has been perpetrated against the title industry for decades:

- The order is placed via email from an unknown person.

- Purchase and sale agreement is generic in format.

- All communication is through email; no phone contact or in-person contact.

- The property was purchased sight unseen by a buyer in Canada.

- The earnest money deposit was drawn from a foreign bank.

There were steps the escrow officer could have taken to stop the fraudulent transaction, they include:

- The property was in the same area as the title company. The property was owner occupied. The escrow officer could have easily reached out to the seller to confirm whether the transaction was fraudulent.

- The escrow officer should not have disbursed against uncollected funds. An official check drawn from a federal reserve outside of the area where deposited checks can take up to five business banking days to clear. The check was deposited on Tuesday, September 12, 2023, and the wire went out on Thursday, September 14, 2023.

- The escrow officer should have recognized the second check as fictitious, by checking the ABA routing number in the top right-hand corner to see if it matched on the MICR line of the check.

- The buyer tendered funds by check, the refund should have also been tendered by check. The escrow officer should not have returned funds via wire transfer.

- The funds should not have been wired to an unrelated third party instead of the purchaser named in the purchase and sale agreement.

| |

| |

|